“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards The Sherwin-Williams Company (NYSE:SHW) and see how it was affected.

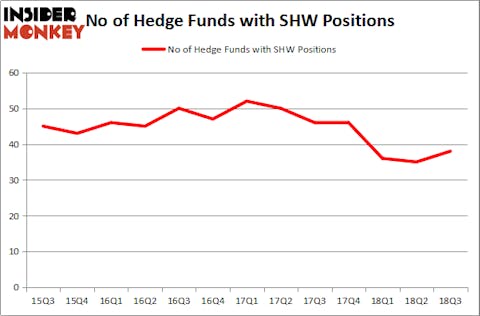

Is The Sherwin-Williams Company (NYSE:SHW) a buy, sell, or hold? The best stock pickers are betting on the stock. The number of long hedge fund positions went up by 3 lately. Our calculations also showed that SHW isn’t among the 30 most popular stocks among hedge funds. SHW was in 38 hedge funds’ portfolios at the end of the third quarter of 2018. There were 35 hedge funds in our database with SHW positions at the end of the previous quarter.

In the eyes of most market participants, hedge funds are viewed as unimportant, outdated financial vehicles of years past. While there are over 8,000 funds in operation at the moment, We look at the masters of this group, approximately 700 funds. Most estimates calculate that this group of people direct the lion’s share of the smart money’s total asset base, and by tracking their unrivaled stock picks, Insider Monkey has figured out various investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s go over the recent hedge fund action encompassing The Sherwin-Williams Company (NYSE:SHW).

What does the smart money think about The Sherwin-Williams Company (NYSE:SHW)?

At Q3’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from one quarter earlier. By comparison, 46 hedge funds held shares or bullish call options in SHW heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Chilton Investment Company held the most valuable stake in The Sherwin-Williams Company (NYSE:SHW), which was worth $220.6 million at the end of the third quarter. On the second spot was Alkeon Capital Management which amassed $159.6 million worth of shares. Moreover, Citadel Investment Group, Iridian Asset Management, and Millennium Management were also bullish on The Sherwin-Williams Company (NYSE:SHW), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have jumped into The Sherwin-Williams Company (NYSE:SHW) headfirst. Iridian Asset Management, managed by David Cohen and Harold Levy, established the most outsized position in The Sherwin-Williams Company (NYSE:SHW). Iridian Asset Management had $123.7 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $94.4 million investment in the stock during the quarter. The other funds with brand new SHW positions are James Crichton’s Hitchwood Capital Management, Joel Greenblatt’s Gotham Asset Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The Sherwin-Williams Company (NYSE:SHW) but similarly valued. We will take a look at Koninklijke Philips NV (NYSE:PHG), Prudential Financial Inc (NYSE:PRU), Orange S.A. (NYSE:ORAN), and Exelon Corporation (NYSE:EXC). This group of stocks’ market caps match SHW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHG | 15 | 456151 | 1 |

| PRU | 33 | 1057477 | 3 |

| ORAN | 1 | 3626 | 0 |

| EXC | 33 | 2043028 | 13 |

| Average | 20.5 | 890071 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $890 million. That figure was $1.41 billion in SHW’s case. Prudential Financial Inc (NYSE:PRU) is the most popular stock in this table. On the other hand 0 is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks The Sherwin-Williams Company (NYSE:SHW) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.