Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Solaredge Technologies Inc (NASDAQ:SEDG) changed recently.

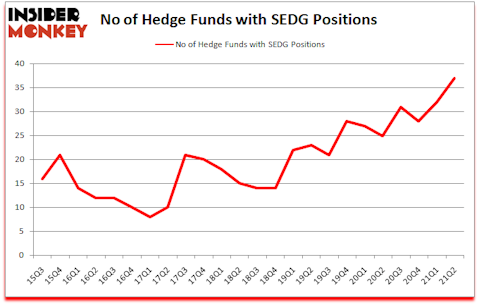

Solaredge Technologies Inc (NASDAQ:SEDG) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Solaredge Technologies Inc (NASDAQ:SEDG) was in 37 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 32. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 32 hedge funds in our database with SEDG holdings at the end of March. Our calculations also showed that SEDG isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In today’s marketplace there are numerous formulas stock market investors can use to size up publicly traded companies. A couple of the best formulas are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can outclass the S&P 500 by a healthy amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Ken Griffin of Citadel Investment Group

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, we like undervalued, EBITDA-positive growth stocks, so we are checking out stock pitches like this emerging biotech stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s analyze the new hedge fund action regarding Solaredge Technologies Inc (NASDAQ:SEDG).

Do Hedge Funds Think SEDG Is A Good Stock To Buy Now?

At Q2’s end, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 16% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SEDG over the last 24 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Impax Asset Management was the largest shareholder of Solaredge Technologies Inc (NASDAQ:SEDG), with a stake worth $212.5 million reported as of the end of June. Trailing Impax Asset Management was Millennium Management, which amassed a stake valued at $110.5 million. Citadel Investment Group, Citadel Investment Group, and Rima Senvest Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Montanaro Asset Management allocated the biggest weight to Solaredge Technologies Inc (NASDAQ:SEDG), around 4.57% of its 13F portfolio. Quaero Capital is also relatively very bullish on the stock, earmarking 4.31 percent of its 13F equity portfolio to SEDG.

As aggregate interest increased, specific money managers have been driving this bullishness. Rima Senvest Management, managed by Richard Mashaal, created the most valuable position in Solaredge Technologies Inc (NASDAQ:SEDG). Rima Senvest Management had $56.9 million invested in the company at the end of the quarter. Jack Woodruff’s Candlestick Capital Management also initiated a $25.6 million position during the quarter. The following funds were also among the new SEDG investors: Steve Cohen’s Point72 Asset Management, Doron Breen and Mori Arkin’s Sphera Global Healthcare Fund, and Robert Charles Gibbins’s Autonomy Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Solaredge Technologies Inc (NASDAQ:SEDG) but similarly valued. We will take a look at PulteGroup, Inc. (NYSE:PHM), Telefonica Brasil SA (NYSE:VIV), Ceridian HCM Holding Inc. (NYSE:CDAY), Leidos Holdings Inc (NYSE:LDOS), RH (NYSE:RH), CenterPoint Energy, Inc. (NYSE:CNP), and Signature Bank (NASDAQ:SBNY). This group of stocks’ market values are closest to SEDG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHM | 34 | 948574 | -8 |

| VIV | 9 | 59331 | 0 |

| CDAY | 25 | 1476874 | -3 |

| LDOS | 22 | 170773 | 4 |

| RH | 54 | 4331314 | 4 |

| CNP | 20 | 287723 | -5 |

| SBNY | 43 | 787102 | 3 |

| Average | 29.6 | 1151670 | -0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.6 hedge funds with bullish positions and the average amount invested in these stocks was $1152 million. That figure was $676 million in SEDG’s case. RH (NYSE:RH) is the most popular stock in this table. On the other hand Telefonica Brasil SA (NYSE:VIV) is the least popular one with only 9 bullish hedge fund positions. Solaredge Technologies Inc (NASDAQ:SEDG) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for SEDG is 71.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 21.8% in 2021 through October 11th and beat the market again by 4.4 percentage points. Unfortunately SEDG wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on SEDG were disappointed as the stock returned 0.2% since the end of June (through 10/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Solaredge Technologies Inc. (NASDAQ:SEDG)

Follow Solaredge Technologies Inc. (NASDAQ:SEDG)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 20 Defense Contractors in 2021

- 10 Best Stocks To Buy For 2021

- 10 Best Biotech Stocks to Buy According to Cathie Wood

Disclosure: None. This article was originally published at Insider Monkey.