It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Sarepta Therapeutics Inc (NASDAQ:SRPT) .

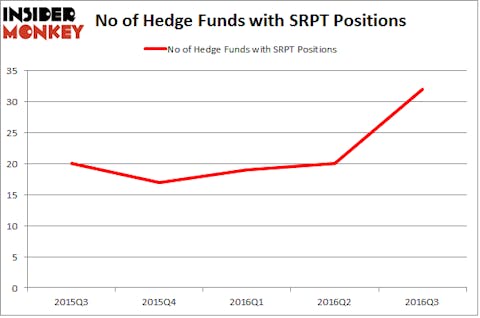

Sarepta Therapeutics Inc (NASDAQ:SRPT) investors should be aware of an increase in hedge fund sentiment in recent months. SRPT was in 32 hedge funds’ portfolios at the end of September. There were 20 hedge funds in our database with SRPT positions at the end of the previous quarter. At the end of this article we will also compare SRPT to other stocks including Air Lease Corp (NYSE:AL), Vector Group Ltd (NYSE:VGR), and Masimo Corporation (NASDAQ:MASI) to get a better sense of its popularity.

Follow Sarepta Therapeutics Inc. (NASDAQ:SRPT)

Follow Sarepta Therapeutics Inc. (NASDAQ:SRPT)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Syda Productions/Shutterstock.com

What have hedge funds been doing with Sarepta Therapeutics Inc (NASDAQ:SRPT)?

Heading into the fourth quarter of 2016, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 60% from the second quarter of 2016. On the other hand, there were a total of 17 hedge funds with a bullish position in SRPT at the beginning of this year. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Perceptive Advisors, led by Joseph Edelman, holds the most valuable position in Sarepta Therapeutics Inc (NASDAQ:SRPT). Perceptive Advisors has a $208.5 million position in the stock, comprising 13.5% of its 13F portfolio. The second most bullish fund manager is Point72 Asset Management, led by Steve Cohen, holding a $201.7 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish include Israel Englander’s Millennium Management, and Behzad Aghazadeh’s venBio Select Advisor. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.