Is Quaker Chemical Corp (NYSE:KWR) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

Is Quaker Chemical Corp (NYSE:KWR) undervalued? The best stock pickers are getting more optimistic. The number of bullish hedge fund bets advanced by 3 recently. Our calculations also showed that kwr isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the new hedge fund action surrounding Quaker Chemical Corp (NYSE:KWR).

What have hedge funds been doing with Quaker Chemical Corp (NYSE:KWR)?

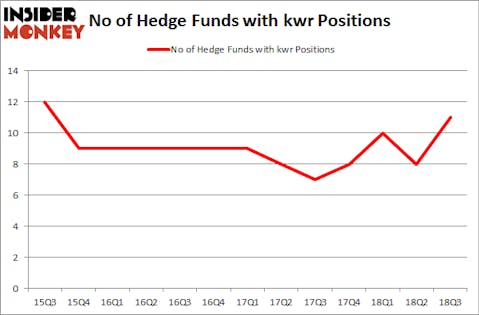

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 38% from the previous quarter. The graph below displays the number of hedge funds with bullish position in KWR over the last 13 quarters. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the largest position in Quaker Chemical Corp (NYSE:KWR). Royce & Associates has a $146.3 million position in the stock, comprising 1% of its 13F portfolio. On Royce & Associates’s heels is Jim Simons of Renaissance Technologies, with a $13 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Mario Gabelli’s GAMCO Investors, Israel Englander’s Millennium Management and Brandon Haley’s Holocene Advisors.

Consequently, key hedge funds were breaking ground themselves. Millennium Management, managed by Israel Englander, assembled the most outsized position in Quaker Chemical Corp (NYSE:KWR). Millennium Management had $0.8 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.3 million investment in the stock during the quarter. The other funds with brand new KWR positions are Leighton Welch’s Welch Capital Partners and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Quaker Chemical Corp (NYSE:KWR) but similarly valued. We will take a look at Weatherford International plc (NYSE:WFT), TreeHouse Foods Inc. (NYSE:THS), Triton International Limited (NYSE:TRTN), and AeroVironment, Inc. (NASDAQ:AVAV). This group of stocks’ market caps are similar to KWR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WFT | 21 | 362168 | -5 |

| THS | 18 | 257934 | 1 |

| TRTN | 12 | 60818 | -3 |

| AVAV | 13 | 53276 | 1 |

| Average | 16 | 183549 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $184 million. That figure was $163 million in KWR’s case. Weatherford International plc (NYSE:WFT) is the most popular stock in this table. On the other hand Triton International Limited (NYSE:TRTN) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Quaker Chemical Corp (NYSE:KWR) is even less popular than TRTN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.