The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Phibro Animal Health Corp (NASDAQ:PAHC), and what that likely means for the prospects of the company and its stock.

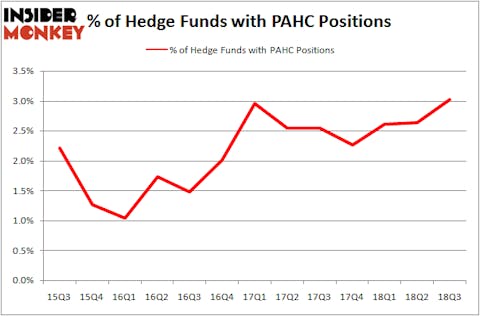

Is Phibro Animal Health Corp (NASDAQ:PAHC) the right investment to pursue these days? The smart money is getting more optimistic. The number of bullish hedge fund bets inched up by 4 in recent months. Our calculations also showed that PAHC isn’t among the 30 most popular stocks among hedge funds. PAHC was in 21 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with PAHC holdings at the end of the previous quarter.

To the average investor there are several indicators shareholders use to grade stocks. A couple of the most under-the-radar indicators are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can outperform their index-focused peers by a superb amount (see the details here).

We’re going to take a glance at the latest hedge fund action regarding Phibro Animal Health Corp (NASDAQ:PAHC).

Hedge fund activity in Phibro Animal Health Corp (NASDAQ:PAHC)

Heading into the fourth quarter of 2018, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 24% from the second quarter of 2018. By comparison, 15 hedge funds held shares or bullish call options in PAHC heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Phibro Animal Health Corp (NASDAQ:PAHC), which was worth $34.5 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $12.6 million worth of shares. Moreover, Millennium Management, GLG Partners, and Citadel Investment Group were also bullish on Phibro Animal Health Corp (NASDAQ:PAHC), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Laurion Capital Management, managed by Benjamin A. Smith, assembled the most valuable position in Phibro Animal Health Corp (NASDAQ:PAHC). Laurion Capital Management had $0.4 million invested in the company at the end of the quarter. Alec Litowitz and Ross Laser’s Magnetar Capital also made a $0.4 million investment in the stock during the quarter. The following funds were also among the new PAHC investors: Ken Griffin’s Citadel Investment Group, Jeffrey Talpins’s Element Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Phibro Animal Health Corp (NASDAQ:PAHC). These stocks are Rapid7 Inc (NASDAQ:RPD), SPS Commerce, Inc. (NASDAQ:SPSC), IAMGOLD Corporation (NYSE:IAG), and Nevro Corp (NYSE:NVRO). This group of stocks’ market caps match PAHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RPD | 17 | 221660 | 3 |

| SPSC | 19 | 160967 | -1 |

| IAG | 12 | 107461 | -3 |

| NVRO | 24 | 381162 | 2 |

| Average | 18 | 217813 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $218 million. That figure was $77 million in PAHC’s case. Nevro Corp (NYSE:NVRO) is the most popular stock in this table. On the other hand IAMGOLD Corporation (NYSE:IAG) is the least popular one with only 12 bullish hedge fund positions. Phibro Animal Health Corp (NASDAQ:PAHC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NVRO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.