Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Ovintiv Inc. (NYSE:OVV) changed recently.

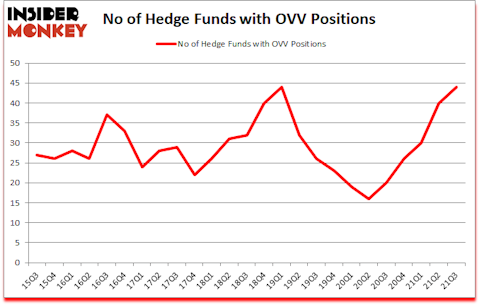

Ovintiv Inc. (NYSE:OVV) investors should pay attention to an increase in support from the world’s most elite money managers of late. Ovintiv Inc. (NYSE:OVV) was in 44 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 44. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that OVV isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to take a look at the key hedge fund action encompassing Ovintiv Inc. (NYSE:OVV).

Do Hedge Funds Think OVV Is A Good Stock To Buy Now?

At the end of September, a total of 44 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards OVV over the last 25 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, John Overdeck and David Siegel’s Two Sigma Advisors has the most valuable position in Ovintiv Inc. (NYSE:OVV), worth close to $99 million, amounting to 0.3% of its total 13F portfolio. Sitting at the No. 2 spot is Len Kipp and Xavier Majic of Maple Rock Capital, with a $88.5 million position; the fund has 12.4% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Israel Englander’s Millennium Management, Steve Cohen’s Point72 Asset Management and Stephen Mildenhall’s Contrarius Investment Management. In terms of the portfolio weights assigned to each position Maple Rock Capital allocated the biggest weight to Ovintiv Inc. (NYSE:OVV), around 12.4% of its 13F portfolio. Yaupon Capital is also relatively very bullish on the stock, designating 3.47 percent of its 13F equity portfolio to OVV.

As industrywide interest jumped, some big names have jumped into Ovintiv Inc. (NYSE:OVV) headfirst. Anomaly Capital Management, managed by Ben Jacobs, created the most outsized position in Ovintiv Inc. (NYSE:OVV). Anomaly Capital Management had $23 million invested in the company at the end of the quarter. Till Bechtolsheimer’s Arosa Capital Management also initiated a $9.9 million position during the quarter. The other funds with new positions in the stock are Ken Heebner’s Capital Growth Management, Steve Pattyn’s Yaupon Capital, and Crispin Odey’s Odey Asset Management Group.

Let’s go over hedge fund activity in other stocks similar to Ovintiv Inc. (NYSE:OVV). These stocks are The Gap Inc. (NYSE:GPS), CRISPR Therapeutics AG (NASDAQ:CRSP), Jabil Inc. (NYSE:JBL), Vertiv Holdings Co (NYSE:VRT), Knight-Swift Transportation Holdings Inc. (NYSE:KNX), Hyatt Hotels Corporation (NYSE:H), and IPG Photonics Corporation (NASDAQ:IPGP). This group of stocks’ market values match OVV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPS | 28 | 370571 | -15 |

| CRSP | 43 | 1215665 | 9 |

| JBL | 27 | 517374 | 1 |

| VRT | 36 | 811401 | 0 |

| KNX | 21 | 261747 | -5 |

| H | 37 | 1003042 | 14 |

| IPGP | 25 | 435718 | 2 |

| Average | 31 | 659360 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $659 million. That figure was $684 million in OVV’s case. CRISPR Therapeutics AG (NASDAQ:CRSP) is the most popular stock in this table. On the other hand Knight-Swift Transportation Holdings Inc. (NYSE:KNX) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Ovintiv Inc. (NYSE:OVV) is more popular among hedge funds. Our overall hedge fund sentiment score for OVV is 89. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Unfortunately OVV wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on OVV were disappointed as the stock returned 5.7% since the end of the third quarter (through 11/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Ovintiv Inc. (NYSE:OVV)

Follow Ovintiv Inc. (NYSE:OVV)

Receive real-time insider trading and news alerts

Suggested Articles:

- 20 Best Airlines in the World in 2021

- 10 Best Software Stocks to Buy According to Billionaire Paul Tudor Jones

- 10 Biggest Solar Companies

Disclosure: None. This article was originally published at Insider Monkey.