The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Miragen Therapeutics, Inc. (NASDAQ:MGEN).

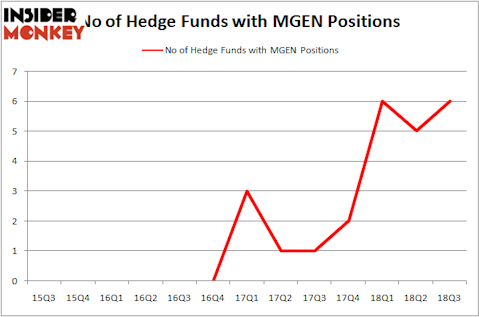

Is Miragen Therapeutics, Inc. (NASDAQ:MGEN) a bargain? Investors who are in the know are betting on the stock. The number of bullish hedge fund positions improved by 1 in recent months. Our calculations also showed that MGEN isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are perceived as unimportant, outdated investment vehicles of yesteryear. While there are more than 8,000 funds in operation at present, Our researchers choose to focus on the bigwigs of this club, approximately 700 funds. These money managers shepherd bulk of all hedge funds’ total capital, and by monitoring their unrivaled investments, Insider Monkey has identified numerous investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to check out the fresh hedge fund action surrounding Miragen Therapeutics, Inc. (NASDAQ:MGEN).

How are hedge funds trading Miragen Therapeutics, Inc. (NASDAQ:MGEN)?

Heading into the fourth quarter of 2018, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the second quarter of 2018. By comparison, 2 hedge funds held shares or bullish call options in MGEN heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Opaleye Management, managed by James A. Silverman, holds the biggest position in Miragen Therapeutics, Inc. (NASDAQ:MGEN). Opaleye Management has a $7.8 million position in the stock, comprising 2% of its 13F portfolio. Coming in second is 683 Capital Partners, managed by Ari Zweiman, which holds a $2.8 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining peers that are bullish consist of Steve Cohen’s Point72 Asset Management, Israel Englander’s Millennium Management and Noam Gottesman’s GLG Partners.

As one would reasonably expect, key money managers have jumped into Miragen Therapeutics, Inc. (NASDAQ:MGEN) headfirst. 683 Capital Partners, managed by Ari Zweiman, created the most valuable position in Miragen Therapeutics, Inc. (NASDAQ:MGEN). 683 Capital Partners had $2.8 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $2 million position during the quarter. The only other fund with a brand new MGEN position is Ken Griffin’s Citadel Investment Group.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Miragen Therapeutics, Inc. (NASDAQ:MGEN) but similarly valued. These stocks are BioDelivery Sciences International, Inc. (NASDAQ:BDSI), County Bancorp, Inc. (NASDAQ:ICBK), New Home Company Inc (NYSE:NWHM), and SI Financial Group, Inc. (NASDAQ:SIFI). This group of stocks’ market valuations resemble MGEN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BDSI | 16 | 55974 | 2 |

| ICBK | 2 | 3260 | 0 |

| NWHM | 4 | 22728 | -2 |

| SIFI | 6 | 17530 | -1 |

| Average | 7 | 24873 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $13 million in MGEN’s case. BioDelivery Sciences International, Inc. (NASDAQ:BDSI) is the most popular stock in this table. On the other hand County Bancorp, Inc. (NASDAQ:ICBK) is the least popular one with only 2 bullish hedge fund positions. Miragen Therapeutics, Inc. (NASDAQ:MGEN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BDSI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.