Is Lamb Weston Holdings, Inc. (NYSE:LW) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

Lamb Weston Holdings, Inc. (NYSE:LW) investors should be aware of an increase in hedge fund interest recently. Our calculations also showed that lw isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action surrounding Lamb Weston Holdings, Inc. (NYSE:LW).

Hedge fund activity in Lamb Weston Holdings, Inc. (NYSE:LW)

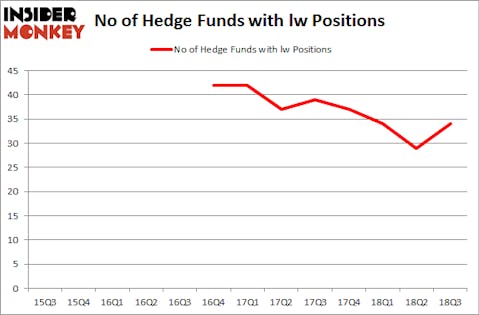

Heading into the fourth quarter of 2018, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in LW over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Arrowstreet Capital held the most valuable stake in Lamb Weston Holdings, Inc. (NYSE:LW), which was worth $203 million at the end of the third quarter. On the second spot was D E Shaw which amassed $134.8 million worth of shares. Moreover, Renaissance Technologies, Two Creeks Capital Management, and Two Sigma Advisors were also bullish on Lamb Weston Holdings, Inc. (NYSE:LW), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, created the most outsized position in Lamb Weston Holdings, Inc. (NYSE:LW). LMR Partners had $4.8 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $3.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Charles Davidson and Joseph Jacobs’s Wexford Capital, Ian Simm’s Impax Asset Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to Lamb Weston Holdings, Inc. (NYSE:LW). We will take a look at Zions Bancorporation, National Association (NASDAQ:ZION), W.R. Berkley Corporation (NYSE:WRB), Torchmark Corporation (NYSE:TMK), and Bunge Limited (NYSE:BG). This group of stocks’ market valuations are closest to LW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZION | 32 | 797532 | -2 |

| WRB | 17 | 425023 | 1 |

| TMK | 21 | 762817 | -2 |

| BG | 39 | 1301171 | 0 |

| Average | 27.25 | 821636 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $822 million. That figure was $909 million in LW’s case. Bunge Limited (NYSE:BG) is the most popular stock in this table. On the other hand W.R. Berkley Corporation (NYSE:WRB) is the least popular one with only 17 bullish hedge fund positions. Lamb Weston Holdings, Inc. (NYSE:LW) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.