The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Jabil Inc. (NYSE:JBL).

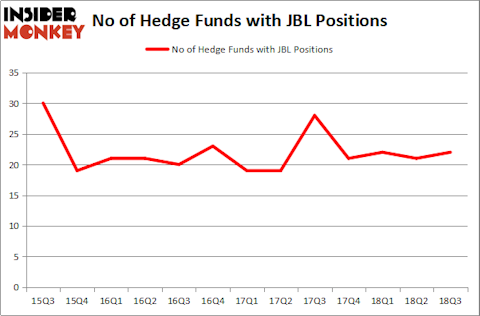

Jabil Inc. (NYSE:JBL) shareholders have witnessed an increase in hedge fund sentiment in recent months. JBL was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. There were 21 hedge funds in our database with JBL holdings at the end of the previous quarter. Our calculations also showed that JBL isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the key hedge fund action regarding Jabil Inc. (NYSE:JBL).

Hedge fund activity in Jabil Inc. (NYSE:JBL)

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in JBL heading into this year. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Jabil Inc. (NYSE:JBL), which was worth $172.5 million at the end of the third quarter. On the second spot was Simcoe Capital Management which amassed $37.8 million worth of shares. Moreover, Pzena Investment Management, Simcoe Capital Management, and Adage Capital Management were also bullish on Jabil Inc. (NYSE:JBL), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds were breaking ground themselves. Simcoe Capital Management, managed by Jeffrey Jacobowitz, assembled the largest call position in Jabil Inc. (NYSE:JBL). Simcoe Capital Management had $16.2 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $1.1 million position during the quarter. The other funds with new positions in the stock are George Hall’s Clinton Group, Jeffrey Talpins’s Element Capital Management, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Jabil Inc. (NYSE:JBL) but similarly valued. We will take a look at OneMain Holdings Inc (NYSE:OMF), CACI International Inc (NYSE:CACI), Trex Company, Inc. (NYSE:TREX), and Cameco Corporation (NYSE:CCJ). All of these stocks’ market caps match JBL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMF | 26 | 318605 | 4 |

| CACI | 20 | 96681 | 6 |

| TREX | 17 | 68983 | 5 |

| CCJ | 19 | 291752 | -2 |

| Average | 20.5 | 194005 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $194 million. That figure was $298 million in JBL’s case. OneMain Holdings Inc (NYSE:OMF) is the most popular stock in this table. On the other hand Trex Company, Inc. (NYSE:TREX) is the least popular one with only 17 bullish hedge fund positions. Jabil Inc. (NYSE:JBL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OMF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.