Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards General Electric Company (NYSE:GE).

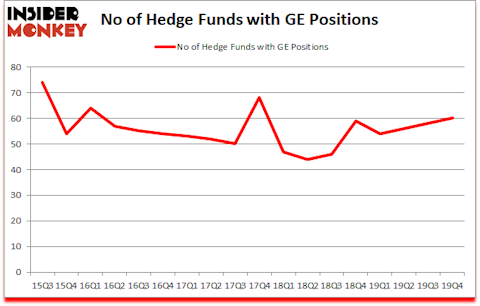

General Electric Company (NYSE:GE) was in 60 hedge funds’ portfolios at the end of December. GE investors should be aware of an increase in support from the world’s most elite money managers lately. There were 58 hedge funds in our database with GE holdings at the end of the previous quarter. Our calculations also showed that GE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Boykin Curry of Eagle Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Now let’s review the fresh hedge fund action regarding General Electric Company (NYSE:GE).

How are hedge funds trading General Electric Company (NYSE:GE)?

Heading into the first quarter of 2020, a total of 60 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GE over the last 18 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Eagle Capital Management was the largest shareholder of General Electric Company (NYSE:GE), with a stake worth $1357.4 million reported as of the end of September. Trailing Eagle Capital Management was Renaissance Technologies, which amassed a stake valued at $844 million. Pzena Investment Management, Trian Partners, and Southeastern Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Southeastern Asset Management allocated the biggest weight to General Electric Company (NYSE:GE), around 8.09% of its 13F portfolio. Trian Partners is also relatively very bullish on the stock, setting aside 7.56 percent of its 13F equity portfolio to GE.

Now, key hedge funds have jumped into General Electric Company (NYSE:GE) headfirst. Hitchwood Capital Management, managed by James Crichton, established the largest position in General Electric Company (NYSE:GE). Hitchwood Capital Management had $46.9 million invested in the company at the end of the quarter. Doug Silverman and Alexander Klabin’s Senator Investment Group also initiated a $44.6 million position during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Alexander Mitchell’s Scopus Asset Management.

Let’s now review hedge fund activity in other stocks similar to General Electric Company (NYSE:GE). These stocks are British American Tobacco plc (NYSE:BTI), CVS Caremark Corporation (NYSE:CVS), Altria Group Inc (NYSE:MO), and U.S. Bancorp (NYSE:USB). This group of stocks’ market values resemble GE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BTI | 9 | 607241 | 0 |

| CVS | 58 | 969440 | 7 |

| MO | 54 | 1750020 | 1 |

| USB | 50 | 8686368 | 3 |

| Average | 42.75 | 3003267 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 42.75 hedge funds with bullish positions and the average amount invested in these stocks was $3003 million. That figure was $6211 million in GE’s case. CVS Caremark Corporation (NYSE:CVS) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSE:BTI) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks General Electric Company (NYSE:GE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on GE as the stock returned 0.4% so far in Q1 (through March 2nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.