We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article we look at what those investors think of Fiesta Restaurant Group Inc (NASDAQ:FRGI).

Fiesta Restaurant Group Inc (NASDAQ:FRGI) has experienced an increase in hedge fund sentiment in recent months. Our calculations also showed that frgi isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a glance at the recent hedge fund action regarding Fiesta Restaurant Group Inc (NASDAQ:FRGI).

What have hedge funds been doing with Fiesta Restaurant Group Inc (NASDAQ:FRGI)?

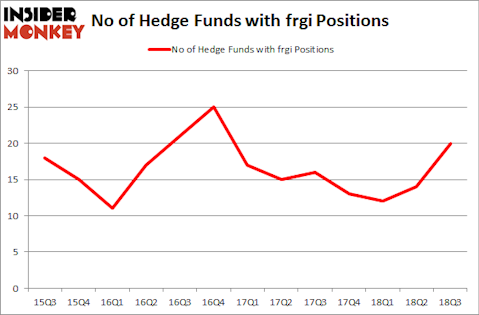

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FRGI over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Leucadia National was the largest shareholder of Fiesta Restaurant Group Inc (NASDAQ:FRGI), with a stake worth $87.5 million reported as of the end of September. Trailing Leucadia National was Private Capital Management, which amassed a stake valued at $11.2 million. Birch Run Capital, Maverick Capital, and Columbus Circle Investors were also very fond of the stock, giving the stock large weights in their portfolios.

Now, some big names were breaking ground themselves. Blue Mountain Capital, managed by Andrew Feldstein and Stephen Siderow, assembled the most outsized position in Fiesta Restaurant Group Inc (NASDAQ:FRGI). Blue Mountain Capital had $1.8 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $1.3 million position during the quarter. The following funds were also among the new FRGI investors: Paul Tudor Jones’s Tudor Investment Corp, Alec Litowitz and Ross Laser’s Magnetar Capital, and Jim Simons’s Renaissance Technologies.

Let’s go over hedge fund activity in other stocks similar to Fiesta Restaurant Group Inc (NASDAQ:FRGI). These stocks are Merchants Bancorp (NASDAQ:MBIN), Xperi Corporation (NASDAQ:XPER), Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), and RadNet Inc. (NASDAQ:RDNT). This group of stocks’ market caps resemble FRGI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MBIN | 8 | 12595 | 0 |

| XPER | 16 | 86113 | 2 |

| SCHN | 19 | 57579 | 1 |

| RDNT | 11 | 99896 | 0 |

| Average | 13.5 | 64046 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $64 million. That figure was $157 million in FRGI’s case. Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) is the most popular stock in this table. On the other hand Merchants Bancorp (NASDAQ:MBIN) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Fiesta Restaurant Group Inc (NASDAQ:FRGI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.