In this article you are going to find out whether hedge funds think Enphase Energy Inc (NASDAQ:ENPH) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

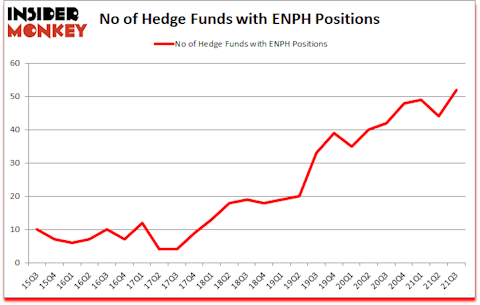

Enphase Energy Inc (NASDAQ:ENPH) has experienced an increase in hedge fund sentiment of late. Enphase Energy Inc (NASDAQ:ENPH) was in 52 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 49. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that ENPH isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s check out the new hedge fund action regarding Enphase Energy Inc (NASDAQ:ENPH).

Do Hedge Funds Think ENPH Is A Good Stock To Buy Now?

At the end of September, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from one quarter earlier. By comparison, 42 hedge funds held shares or bullish call options in ENPH a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Enphase Energy Inc (NASDAQ:ENPH), with a stake worth $210.1 million reported as of the end of September. Trailing Citadel Investment Group was Greenvale Capital, which amassed a stake valued at $85.5 million. Sylebra Capital Management, Millennium Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Greenvale Capital allocated the biggest weight to Enphase Energy Inc (NASDAQ:ENPH), around 10.31% of its 13F portfolio. Quaero Capital is also relatively very bullish on the stock, setting aside 5.2 percent of its 13F equity portfolio to ENPH.

As industrywide interest jumped, some big names have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, initiated the most outsized position in Enphase Energy Inc (NASDAQ:ENPH). Holocene Advisors had $32.8 million invested in the company at the end of the quarter. Louis Bacon’s Moore Global Investments also made a $16.4 million investment in the stock during the quarter. The other funds with brand new ENPH positions are Steve Cohen’s Point72 Asset Management, Jinghua Yan’s TwinBeech Capital, and Greg Eisner’s Engineers Gate Manager.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Enphase Energy Inc (NASDAQ:ENPH) but similarly valued. These stocks are Dynatrace, Inc. (NYSE:DT), NetApp Inc. (NASDAQ:NTAP), Teledyne Technologies Incorporated (NYSE:TDY), Citizens Financial Group Inc (NYSE:CFG), Entergy Corporation (NYSE:ETR), RingCentral Inc (NYSE:RNG), and Darden Restaurants, Inc. (NYSE:DRI). This group of stocks’ market values are closest to ENPH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DT | 41 | 2389054 | -9 |

| NTAP | 29 | 671456 | -2 |

| TDY | 38 | 1703394 | 2 |

| CFG | 34 | 361791 | -2 |

| ETR | 30 | 283209 | -1 |

| RNG | 48 | 2905250 | 1 |

| DRI | 25 | 337086 | -19 |

| Average | 35 | 1235891 | -4.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $1236 million. That figure was $638 million in ENPH’s case. RingCentral Inc (NYSE:RNG) is the most popular stock in this table. On the other hand Darden Restaurants, Inc. (NYSE:DRI) is the least popular one with only 25 bullish hedge fund positions. Compared to these stocks Enphase Energy Inc (NASDAQ:ENPH) is more popular among hedge funds. Our overall hedge fund sentiment score for ENPH is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 28.6% in 2021 through November 30th but still managed to beat the market by 5.6 percentage points. Hedge funds were also right about betting on ENPH as the stock returned 66.7% since the end of September (through 11/30) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Enphase Energy Inc. (NASDAQ:ENPH)

Follow Enphase Energy Inc. (NASDAQ:ENPH)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Best American Stocks to Buy Now

- Top 10 Stocks to Buy Right Now

- 15 Biggest Cloud Companies In The World

Disclosure: None. This article was originally published at Insider Monkey.