The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Chase Corporation (NYSEAMEX:CCF) based on those filings.

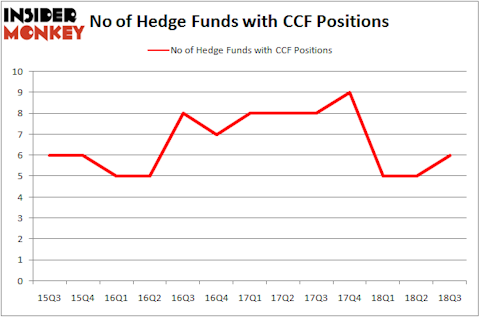

Is Chase Corporation (NYSEAMEX:CCF) a marvelous stock to buy now? Investors who are in the know are taking an optimistic view. The number of long hedge fund bets went up by 1 lately. Our calculations also showed that CCF isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to view the latest hedge fund action surrounding Chase Corporation (NYSEAMEX:CCF).

What does the smart money think about Chase Corporation (NYSEAMEX:CCF)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in CCF heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the biggest position in Chase Corporation (NYSEAMEX:CCF). Royce & Associates has a $45.4 million position in the stock, comprising 0.3% of its 13F portfolio. On Royce & Associates’s heels is Jim Simons of Renaissance Technologies, with a $42.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that hold long positions consist of Cliff Asness’s AQR Capital Management, Israel Englander’s Millennium Management and Roger Ibbotson’s Zebra Capital Management.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Millennium Management, managed by Israel Englander, created the largest position in Chase Corporation (NYSEAMEX:CCF). Millennium Management had $0.6 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also initiated a $0.2 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Chase Corporation (NYSEAMEX:CCF). We will take a look at CTS Corporation (NYSE:CTS), Entercom Communications Corp. (NYSE:ETM), Forum Energy Technologies Inc (NYSE:FET), and Golub Capital BDC Inc (NASDAQ:GBDC). This group of stocks’ market values are closest to CCF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTS | 10 | 112420 | 1 |

| ETM | 14 | 193471 | 2 |

| FET | 9 | 26899 | -1 |

| GBDC | 10 | 37784 | 0 |

| Average | 10.75 | 92644 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $93 million. That figure was $91 million in CCF’s case. Entercom Communications Corp. (NYSE:ETM) is the most popular stock in this table. On the other hand Forum Energy Technologies Inc (NYSE:FET) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Chase Corporation (NYSEAMEX:CCF) is even less popular than FET. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.