Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: AtriCure Inc. (NASDAQ:ATRC).

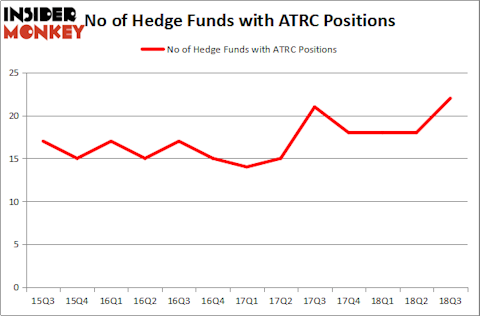

Is AtriCure Inc. (NASDAQ:ATRC) a healthy stock for your portfolio? The best stock pickers are taking a bullish view. The number of long hedge fund bets advanced by 4 in recent months. Our calculations also showed that ATRC isn’t among the 30 most popular stocks among hedge funds.

Today there are dozens of methods shareholders employ to assess stocks. Two of the most under-the-radar methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the top money managers can outpace the broader indices by a significant margin (see the details here).

We’re going to take a gander at the key hedge fund action regarding AtriCure Inc. (NASDAQ:ATRC).

How have hedgies been trading AtriCure Inc. (NASDAQ:ATRC)?

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in ATRC at the beginning of this year. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Among these funds, Hudson Executive Capital held the most valuable stake in AtriCure Inc. (NASDAQ:ATRC), which was worth $83.2 million at the end of the third quarter. On the second spot was Millennium Management which amassed $23.5 million worth of shares. Moreover, Royce & Associates, DAFNA Capital Management, and Tamarack Capital Management were also bullish on AtriCure Inc. (NASDAQ:ATRC), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were breaking ground themselves. Sectoral Asset Management, managed by Jerome Pfund and Michael Sjostrom, established the most valuable position in AtriCure Inc. (NASDAQ:ATRC). Sectoral Asset Management had $8.8 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $6.1 million investment in the stock during the quarter. The following funds were also among the new ATRC investors: Efrem Kamen’s Pura Vida Investments, Matthew Hulsizer’s PEAK6 Capital Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s go over hedge fund activity in other stocks similar to AtriCure Inc. (NASDAQ:ATRC). These stocks are AVROBIO, Inc. (NASDAQ:AVRO), Geopark Ltd (NYSE:GPRK), Hess Midstream Partners LP (NYSE:HESM), and iShares MSCI Europe Financials ETF (NASDAQ:EUFN). All of these stocks’ market caps resemble ATRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVRO | 14 | 249988 | -5 |

| GPRK | 10 | 84765 | -1 |

| HESM | 6 | 9071 | 1 |

| EUFN | 2 | 86190 | 0 |

| Average | 8 | 107504 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $108 million. That figure was $189 million in ATRC’s case. AVROBIO, Inc. (NASDAQ:AVRO) is the most popular stock in this table. On the other hand iShares MSCI Europe Financials ETF (NASDAQ:EUFN) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks AtriCure Inc. (NASDAQ:ATRC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.