Is Atkore International Group Inc. (NYSE:ATKR) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

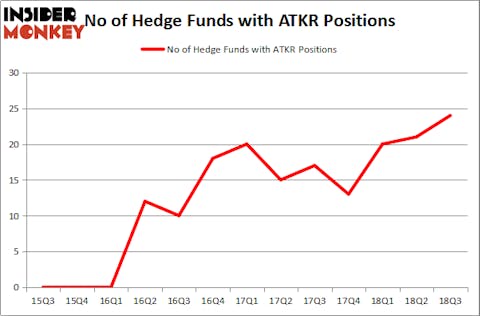

Atkore International Group Inc. (NYSE:ATKR) was in 24 hedge funds’ portfolios at the end of September. ATKR investors should be aware of an increase in enthusiasm from smart money in recent months. There were 21 hedge funds in our database with ATKR holdings at the end of the previous quarter. Our calculations also showed that ATKR isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are viewed as worthless, old investment vehicles of years past. While there are greater than 8,000 funds in operation at the moment, Our researchers hone in on the elite of this club, about 700 funds. These investment experts shepherd the lion’s share of the hedge fund industry’s total capital, and by tailing their first-class equity investments, Insider Monkey has come up with various investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a glance at the new hedge fund action encompassing Atkore International Group Inc. (NYSE:ATKR).

How are hedge funds trading Atkore International Group Inc. (NYSE:ATKR)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ATKR over the last 13 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in Atkore International Group Inc. (NYSE:ATKR) was held by GLG Partners, which reported holding $31.7 million worth of stock at the end of September. It was followed by Millennium Management with a $28.1 million position. Other investors bullish on the company included Two Sigma Advisors, Citadel Investment Group, and AQR Capital Management.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Driehaus Capital, managed by Richard Driehaus, established the biggest position in Atkore International Group Inc. (NYSE:ATKR). Driehaus Capital had $8.6 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $1 million investment in the stock during the quarter. The other funds with brand new ATKR positions are Paul Tudor Jones’s Tudor Investment Corp, David Costen Haley’s HBK Investments, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Atkore International Group Inc. (NYSE:ATKR) but similarly valued. We will take a look at First Trust Dev Mkts Ex-US AlphaDEX ETF (NASDAQ:FDT), Materion Corp (NYSE:MTRN), Southside Bancshares, Inc. (NASDAQ:SBSI), and TIER REIT, Inc. (NYSE:TIER). All of these stocks’ market caps match ATKR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FDT | 1 | 7076 | -1 |

| MTRN | 13 | 98223 | -2 |

| SBSI | 9 | 67248 | -1 |

| TIER | 9 | 82702 | 2 |

| Average | 8 | 63812 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $64 million. That figure was $151 million in ATKR’s case. Materion Corp (NYSE:MTRN) is the most popular stock in this table. On the other hand First Trust Developed Markets Ex-US AlphaDEX Fund (NASDAQ:FDT) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Atkore International Group Inc. (NYSE:ATKR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.