The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards AnaptysBio, Inc. (NASDAQ:ANAB).

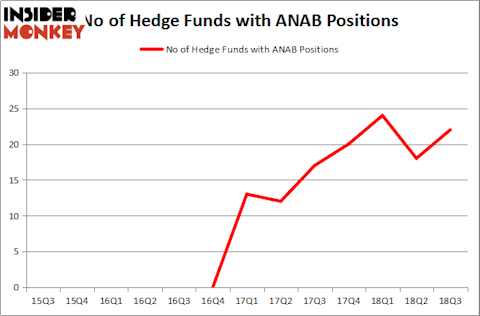

Is AnaptysBio, Inc. (NASDAQ:ANAB) a healthy stock for your portfolio? Hedge funds are turning bullish. The number of long hedge fund bets went up by 4 lately. Our calculations also showed that ANAB isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the key hedge fund action regarding AnaptysBio, Inc. (NASDAQ:ANAB).

How are hedge funds trading AnaptysBio, Inc. (NASDAQ:ANAB)?

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ANAB over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Alan Frazier’s Frazier Healthcare Partners has the largest position in AnaptysBio, Inc. (NASDAQ:ANAB), worth close to $231.1 million, corresponding to 42.3% of its total 13F portfolio. Coming in second is Phill Gross and Robert Atchinson of Adage Capital Management, with a $129.7 million position; 0.3% of its 13F portfolio is allocated to the company. Other members of the smart money that hold long positions consist of Bihua Chen’s Cormorant Asset Management, Christopher James’s Partner Fund Management and Ken Griffin’s Citadel Investment Group.

Now, key hedge funds have been driving this bullishness. Alyeska Investment Group, managed by Anand Parekh, assembled the largest position in AnaptysBio, Inc. (NASDAQ:ANAB). Alyeska Investment Group had $16 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $10.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Steve Cohen’s Point72 Asset Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks similar to AnaptysBio, Inc. (NASDAQ:ANAB). These stocks are Commercial Metals Company (NYSE:CMC), Plantronics, Inc. (NYSE:PLT), Minerals Technologies Inc (NYSE:MTX), and Rowan Companies plc (NYSE:RDC). This group of stocks’ market caps are closest to ANAB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMC | 18 | 178814 | 1 |

| PLT | 25 | 184247 | 6 |

| MTX | 15 | 170727 | -2 |

| RDC | 31 | 761642 | 5 |

| Average | 22.25 | 323858 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $324 million. That figure was $950 million in ANAB’s case. Rowan Companies plc (NYSE:RDC) is the most popular stock in this table. On the other hand Minerals Technologies Inc (NYSE:MTX) is the least popular one with only 15 bullish hedge fund positions. AnaptysBio, Inc. (NASDAQ:ANAB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RDC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.