Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of Sanofi (NASDAQ:SNY) based on that data and determine whether they were really smart about the stock.

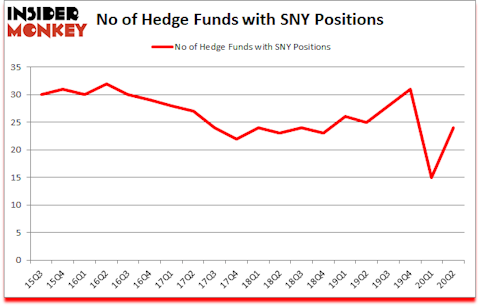

Is Sanofi (NASDAQ:SNY) going to take off soon? Money managers were becoming more confident. The number of bullish hedge fund positions increased by 9 lately. Sanofi (NASDAQ:SNY) was in 24 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 32. Our calculations also showed that SNY isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind let’s take a gander at the recent hedge fund action surrounding Sanofi (NASDAQ:SNY).

What does smart money think about Sanofi (NASDAQ:SNY)?

At second quarter’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SNY over the last 20 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fisher Asset Management held the most valuable stake in Sanofi (NASDAQ:SNY), which was worth $926.8 million at the end of the third quarter. On the second spot was Redmile Group which amassed $62.6 million worth of shares. Sphera Global Healthcare Fund, Arrowstreet Capital, and Point72 Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sphera Global Healthcare Fund allocated the biggest weight to Sanofi (NASDAQ:SNY), around 5.38% of its 13F portfolio. Wallace Capital Management is also relatively very bullish on the stock, setting aside 1.61 percent of its 13F equity portfolio to SNY.

As one would reasonably expect, key hedge funds have jumped into Sanofi (NASDAQ:SNY) headfirst. Redmile Group, managed by Jeremy Green, assembled the most valuable position in Sanofi (NASDAQ:SNY). Redmile Group had $62.6 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $6.8 million investment in the stock during the quarter. The following funds were also among the new SNY investors: Alec Litowitz and Ross Laser’s Magnetar Capital, Nick Thakore’s Diametric Capital, and Michael Gelband’s ExodusPoint Capital.

Let’s check out hedge fund activity in other stocks similar to Sanofi (NASDAQ:SNY). We will take a look at Broadcom Inc (NASDAQ:AVGO), BHP Group (NYSE:BHP), Danaher Corporation (NYSE:DHR), Medtronic plc (NYSE:MDT), Royal Dutch Shell plc (NYSE:RDS), NextEra Energy, Inc. (NYSE:NEE), and Texas Instruments Incorporated (NASDAQ:TXN). This group of stocks’ market valuations are similar to SNY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVGO | 59 | 2378523 | 9 |

| BHP | 16 | 761158 | -2 |

| DHR | 76 | 4287603 | 13 |

| MDT | 58 | 2705363 | -1 |

| RDS | 34 | 1164812 | 6 |

| NEE | 55 | 1943660 | 3 |

| TXN | 55 | 2131731 | 9 |

| Average | 50.4 | 2196121 | 5.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 50.4 hedge funds with bullish positions and the average amount invested in these stocks was $2196 million. That figure was $1220 million in SNY’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand BHP Group (NYSE:BHP) is the least popular one with only 16 bullish hedge fund positions. Sanofi (NASDAQ:SNY) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SNY is 39.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 21.3% in 2020 through September 25th and surpassed the market by 17.7 percentage points. Unfortunately SNY wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); SNY investors were disappointed as the stock returned -0.5% since Q2 and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Sanofi Aventis (NASDAQ:SNY)

Follow Sanofi Aventis (NASDAQ:SNY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.