Is Wynn Resorts, Limited (NASDAQ:WYNN) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

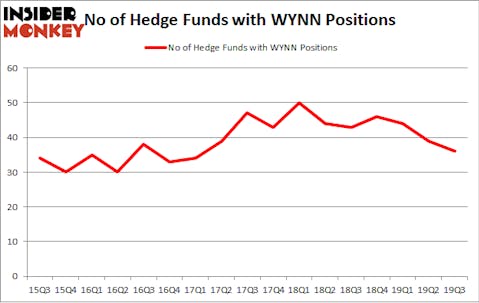

Is Wynn Resorts, Limited (NASDAQ:WYNN) worth your attention right now? The smart money is in a bearish mood. The number of long hedge fund positions were cut by 3 lately. Our calculations also showed that WYNN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are viewed as unimportant, old financial vehicles of years past. While there are greater than 8000 funds with their doors open at present, Our researchers choose to focus on the aristocrats of this club, approximately 750 funds. These investment experts control the lion’s share of the hedge fund industry’s total capital, and by watching their finest equity investments, Insider Monkey has brought to light several investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Mason Hawkins of Southeastern Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the new hedge fund action surrounding Wynn Resorts, Limited (NASDAQ:WYNN).

What does smart money think about Wynn Resorts, Limited (NASDAQ:WYNN)?

At Q3’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the previous quarter. By comparison, 43 hedge funds held shares or bullish call options in WYNN a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Egerton Capital Limited was the largest shareholder of Wynn Resorts, Limited (NASDAQ:WYNN), with a stake worth $407.1 million reported as of the end of September. Trailing Egerton Capital Limited was Sculptor Capital, which amassed a stake valued at $163 million. D1 Capital Partners, Southeastern Asset Management, and Melvin Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Columbus Hill Capital Management allocated the biggest weight to Wynn Resorts, Limited (NASDAQ:WYNN), around 5.2% of its portfolio. Beddow Capital Management is also relatively very bullish on the stock, dishing out 3.07 percent of its 13F equity portfolio to WYNN.

Judging by the fact that Wynn Resorts, Limited (NASDAQ:WYNN) has witnessed a decline in interest from the smart money, it’s easy to see that there exists a select few funds who sold off their entire stakes in the third quarter. It’s worth mentioning that Lone Pine Capital sold off the biggest investment of all the hedgies followed by Insider Monkey, valued at close to $670.4 million in stock, and Lee Ainslie’s Maverick Capital was right behind this move, as the fund sold off about $34.2 million worth. These transactions are interesting, as total hedge fund interest was cut by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Wynn Resorts, Limited (NASDAQ:WYNN) but similarly valued. These stocks are Regency Centers Corporation (NASDAQ:REG), Cenovus Energy Inc (NYSE:CVE), Continental Resources, Inc. (NYSE:CLR), and Alleghany Corporation (NYSE:Y). This group of stocks’ market valuations are closest to WYNN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REG | 16 | 233615 | 4 |

| CVE | 25 | 635156 | 8 |

| CLR | 37 | 434858 | 3 |

| Y | 26 | 404893 | 0 |

| Average | 26 | 427131 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $427 million. That figure was $1171 million in WYNN’s case. Continental Resources, Inc. (NYSE:CLR) is the most popular stock in this table. On the other hand Regency Centers Corp (NASDAQ:REG) is the least popular one with only 16 bullish hedge fund positions. Wynn Resorts, Limited (NASDAQ:WYNN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on WYNN as the stock returned 12.1% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.