Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Guess’, Inc. (NYSE:GES).

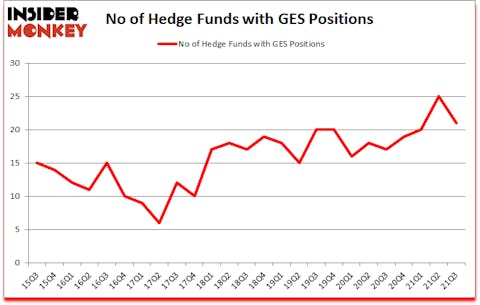

Guess’, Inc. (NYSE:GES) was in 21 hedge funds’ portfolios at the end of September. The all time high for this statistic is 25. GES has experienced a decrease in activity from the world’s largest hedge funds recently. There were 25 hedge funds in our database with GES holdings at the end of June. Our calculations also showed that GES isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Michael Gelband of ExodusPoint Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s take a peek at the fresh hedge fund action encompassing Guess’, Inc. (NYSE:GES).

Do Hedge Funds Think GES Is A Good Stock To Buy Now?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -16% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GES over the last 25 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Point72 Asset Management, managed by Steve Cohen, holds the largest position in Guess’, Inc. (NYSE:GES). Point72 Asset Management has a $17.8 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by D. E. Shaw of D E Shaw, with a $17.5 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism include Israel Englander’s Millennium Management, John Overdeck and David Siegel’s Two Sigma Advisors and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Prentice Capital Management allocated the biggest weight to Guess’, Inc. (NYSE:GES), around 0.27% of its 13F portfolio. Hudson Bay Capital Management is also relatively very bullish on the stock, setting aside 0.09 percent of its 13F equity portfolio to GES.

Because Guess’, Inc. (NYSE:GES) has experienced bearish sentiment from hedge fund managers, it’s easy to see that there is a sect of fund managers that decided to sell off their positions entirely last quarter. Intriguingly, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners sold off the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $6.2 million in stock. Stephen Mildenhall’s fund, Contrarius Investment Management, also dumped its stock, about $4.6 million worth. These moves are interesting, as total hedge fund interest was cut by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Guess’, Inc. (NYSE:GES). We will take a look at Playa Hotels & Resorts N.V. (NASDAQ:PLYA), Anavex Life Sciences Corp. (NASDAQ:AVXL), Sovos Brands Inc. (NASDAQ:SOVO), TTM Technologies, Inc. (NASDAQ:TTMI), F45 Training Holdings Inc. (NYSE:FXLV), Teekay LNG Partners L.P. (NYSE:TGP), and PMV Pharmaceuticals, Inc. (NASDAQ:PMVP). This group of stocks’ market valuations are similar to GES’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLYA | 26 | 395380 | -5 |

| AVXL | 7 | 9515 | 1 |

| SOVO | 17 | 107929 | 17 |

| TTMI | 15 | 77626 | -4 |

| FXLV | 12 | 97921 | 12 |

| TGP | 10 | 26774 | 1 |

| PMVP | 21 | 649247 | 3 |

| Average | 15.4 | 194913 | 3.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.4 hedge funds with bullish positions and the average amount invested in these stocks was $195 million. That figure was $120 million in GES’s case. Playa Hotels & Resorts N.V. (NASDAQ:PLYA) is the most popular stock in this table. On the other hand Anavex Life Sciences Corp. (NASDAQ:AVXL) is the least popular one with only 7 bullish hedge fund positions. Guess’, Inc. (NYSE:GES) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GES is 63. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on GES as the stock returned 13.8% since the end of Q3 (through 12/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Guess Inc (NYSE:GES)

Follow Guess Inc (NYSE:GES)

Receive real-time insider trading and news alerts

Suggested Articles:

- 25 Fastest Growing Real Estate Markets in America

- 10 Best Money Saving Tips According to Experts

- 12 Best Infrastructure Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.