Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Asbury Automotive Group, Inc. (NYSE:ABG) changed recently.

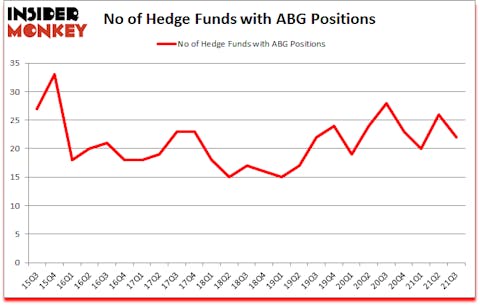

Asbury Automotive Group, Inc. (NYSE:ABG) investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. Asbury Automotive Group, Inc. (NYSE:ABG) was in 22 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 33. Our calculations also showed that ABG isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a look at the recent hedge fund action surrounding Asbury Automotive Group, Inc. (NYSE:ABG).

Do Hedge Funds Think ABG Is A Good Stock To Buy Now?

At third quarter’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ABG over the last 25 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Abrams Capital Management, managed by David Abrams, holds the largest position in Asbury Automotive Group, Inc. (NYSE:ABG). Abrams Capital Management has a $416.7 million position in the stock, comprising 9.1% of its 13F portfolio. The second largest stake is held by Impactive Capital, led by Lauren Taylor Wolfe, holding a $199.9 million position; the fund has 15.7% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Jeffrey Jacobowitz’s Simcoe Capital Management, Ricky Sandler’s Eminence Capital and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Impactive Capital allocated the biggest weight to Asbury Automotive Group, Inc. (NYSE:ABG), around 15.68% of its 13F portfolio. Simcoe Capital Management is also relatively very bullish on the stock, designating 12.7 percent of its 13F equity portfolio to ABG.

Due to the fact that Asbury Automotive Group, Inc. (NYSE:ABG) has witnessed falling interest from hedge fund managers, logic holds that there exists a select few money managers that decided to sell off their positions entirely in the third quarter. Intriguingly, Jerome L. Simon’s Lonestar Capital Management said goodbye to the biggest position of the 750 funds monitored by Insider Monkey, valued at an estimated $2.1 million in stock. Alec Litowitz and Ross Laser’s fund, Magnetar Capital, also sold off its stock, about $0.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 4 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Asbury Automotive Group, Inc. (NYSE:ABG). We will take a look at First Hawaiian, Inc. (NASDAQ:FHB), Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC), Focus Financial Partners Inc. (NASDAQ:FOCS), PennyMac Financial Services Inc (NYSE:PFSI), Eastern Bankshares, Inc. (NASDAQ:EBC), Tronox Holdings Plc (NYSE:TROX), and Definitive Healthcare Corp. (NASDAQ:DH). This group of stocks’ market caps match ABG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FHB | 14 | 165509 | 4 |

| TKC | 9 | 22874 | 2 |

| FOCS | 16 | 101085 | -3 |

| PFSI | 33 | 740702 | 7 |

| EBC | 19 | 126087 | -1 |

| TROX | 38 | 356965 | 2 |

| DH | 23 | 210282 | 23 |

| Average | 21.7 | 246215 | 4.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.7 hedge funds with bullish positions and the average amount invested in these stocks was $246 million. That figure was $996 million in ABG’s case. Tronox Holdings Plc (NYSE:TROX) is the most popular stock in this table. On the other hand Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) is the least popular one with only 9 bullish hedge fund positions. Asbury Automotive Group, Inc. (NYSE:ABG) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ABG is 43.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and beat the market again by 3.6 percentage points. Unfortunately ABG wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ABG were disappointed as the stock returned -12.2% since the end of September (through 12/31) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Asbury Automotive Group Inc (NYSE:ABG)

Follow Asbury Automotive Group Inc (NYSE:ABG)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Cryptocurrency Exchanges Of 2020

- 15 Largest Fast Food Companies Is The World

- 10 Best New Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.