Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Tyler Technologies, Inc. (NYSE:TYL) based on that data.

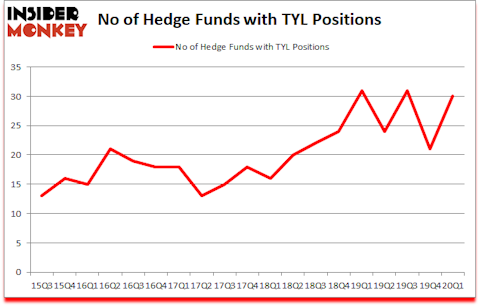

Tyler Technologies, Inc. (NYSE:TYL) has seen an increase in support from the world’s most elite money managers of late. TYL was in 30 hedge funds’ portfolios at the end of March. There were 21 hedge funds in our database with TYL positions at the end of the previous quarter. Our calculations also showed that TYL isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are numerous tools investors can use to analyze stocks. A couple of the best tools are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can outpace their index-focused peers by a healthy amount (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a gander at the new hedge fund action surrounding Tyler Technologies, Inc. (NYSE:TYL).

How are hedge funds trading Tyler Technologies, Inc. (NYSE:TYL)?

At Q1’s end, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 43% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TYL over the last 18 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

More specifically, Praesidium Investment Management Company was the largest shareholder of Tyler Technologies, Inc. (NYSE:TYL), with a stake worth $135.6 million reported as of the end of September. Trailing Praesidium Investment Management Company was RGM Capital, which amassed a stake valued at $74.2 million. Bares Capital Management, Stockbridge Partners, and Columbus Circle Investors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Praesidium Investment Management Company allocated the biggest weight to Tyler Technologies, Inc. (NYSE:TYL), around 10.97% of its 13F portfolio. Totem Point Management is also relatively very bullish on the stock, setting aside 6.9 percent of its 13F equity portfolio to TYL.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Stockbridge Partners, managed by Sharlyn C. Heslam, assembled the largest position in Tyler Technologies, Inc. (NYSE:TYL). Stockbridge Partners had $26.1 million invested in the company at the end of the quarter. Neal Nathani and Darren Dinneen’s Totem Point Management also made a $13.5 million investment in the stock during the quarter. The following funds were also among the new TYL investors: Greg Poole’s Echo Street Capital Management, Cliff Asness’s AQR Capital Management, and Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors.

Let’s now take a look at hedge fund activity in other stocks similar to Tyler Technologies, Inc. (NYSE:TYL). These stocks are Sun Communities Inc (NYSE:SUI), Pioneer Natural Resources Company (NYSE:PXD), Invitation Homes Inc. (NYSE:INVH), and Ryanair Holdings plc (NASDAQ:RYAAY). This group of stocks’ market caps resemble TYL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SUI | 28 | 323201 | -3 |

| PXD | 40 | 534807 | -13 |

| INVH | 27 | 562992 | -6 |

| RYAAY | 22 | 550561 | 0 |

| Average | 29.25 | 492890 | -5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $493 million. That figure was $406 million in TYL’s case. Pioneer Natural Resources Company (NYSE:PXD) is the most popular stock in this table. On the other hand Ryanair Holdings plc (NASDAQ:RYAAY) is the least popular one with only 22 bullish hedge fund positions. Tyler Technologies, Inc. (NYSE:TYL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on TYL as the stock returned 26.6% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Tyler Technologies Inc (NYSE:TYL)

Follow Tyler Technologies Inc (NYSE:TYL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.