We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of June 30. In this article, we look at what those funds think of Leggett & Platt, Inc. (NYSE:LEG) based on that data.

The smart money became more optimistic about Leggett & Platt during Q2, as ownership of the stock rose by 20%. Nonetheless, overall hedge fund sentiment remained muted, as just 1.9% of the funds tracked by our custom database were long the stock. The diversified parts manufacturer has been a stable dividend payer for nearly 5 straight decades, which earned it high billing on our list of 25 Best Dividend Stocks for Retirement.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Hedge fund activity in Leggett & Platt, Inc. (NYSE:LEG)

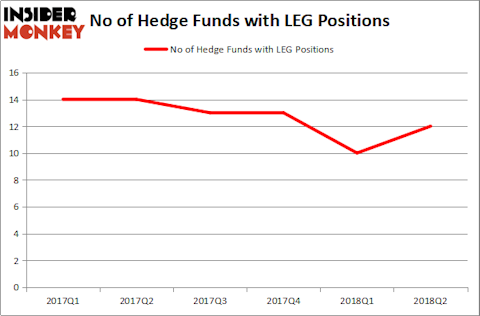

Heading into the fourth quarter of 2018, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 20% rise from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in LEG over the last 6 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in Leggett & Platt, Inc. (NYSE:LEG) was held by SG Capital Management, which reported holding $60.2 million worth of stock as of the end of June. It was followed by Dmitry Balyasny’s Balyasny Asset Management with a $6.6 million position. Other investors bullish on the company included Royce & Associates, Graham Capital Management, and Two Sigma Advisors.

Consequently, key money managers have jumped into Leggett & Platt, Inc. (NYSE:LEG) headfirst. SG Capital Management, managed by Ken Grossman and Glen Schneider, created the largest position in Leggett & Platt, Inc. (NYSE:LEG). The other funds with new positions in the stock included Kenneth Tropin’s Graham Capital Management, Ray Dalio’s Bridgewater Associates, and Israel Englander’s Millennium Management.

Let’s go over hedge fund activity in other stocks similar to Leggett & Platt, Inc. (NYSE:LEG). We will take a look at Wyndham Hotels & Resorts, Inc. (NYSE:WH), Six Flags Entertainment Corp (NYSE:SIX), Murphy Oil Corporation (NYSE:MUR), and Lazard Ltd (NYSE:LAZ). This group of stocks’ market values match LEG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WH | 34 | 841553 | 34 |

| SIX | 16 | 678754 | -1 |

| MUR | 23 | 454102 | 2 |

| LAZ | 17 | 420681 | -2 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $599 million. That figure was $92 million in LEG’s case. Wyndham Hotels & Resorts, Inc. (NYSE:WH) is the most popular stock in this table. On the other hand Six Flags Entertainment Corp (NYSE:SIX) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Leggett & Platt, Inc. (NYSE:LEG) is even less popular than SIX. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money doesn’t see any money to be made right now on this stock.

Disclosure: None. This article was originally published at Insider Monkey.