We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Stamps.com Inc. (NASDAQ:STMP) based on that data.

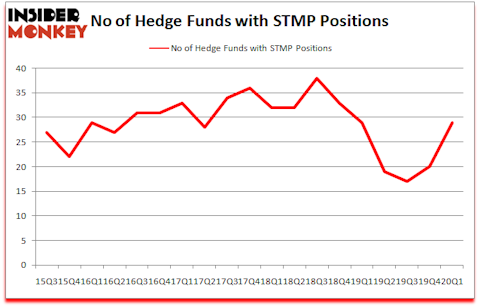

Stamps.com Inc. (NASDAQ:STMP) investors should pay attention to an increase in hedge fund interest lately. Our calculations also showed that STMP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are tons of gauges market participants have at their disposal to grade their stock investments. Some of the most useful gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outperform the S&P 500 by a superb amount (see the details here).

Ken Fisher of Fisher Asset Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out trades like this one as well as this tiny lithium play. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s go over the recent hedge fund action encompassing Stamps.com Inc. (NASDAQ:STMP).

What does smart money think about Stamps.com Inc. (NASDAQ:STMP)?

At the end of the first quarter, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 45% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards STMP over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, D. E. Shaw’s D E Shaw has the biggest position in Stamps.com Inc. (NASDAQ:STMP), worth close to $148.1 million, corresponding to 0.2% of its total 13F portfolio. Sitting at the No. 2 spot is Fisher Asset Management, led by Ken Fisher, holding a $124.4 million position; 0.2% of its 13F portfolio is allocated to the company. Remaining peers that are bullish comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Jeff Osher’s No Street Capital and Jeffrey Jacobowitz’s Simcoe Capital Management. In terms of the portfolio weights assigned to each position Simcoe Capital Management allocated the biggest weight to Stamps.com Inc. (NASDAQ:STMP), around 9.18% of its 13F portfolio. Calixto Global Investors is also relatively very bullish on the stock, earmarking 8.43 percent of its 13F equity portfolio to STMP.

As one would reasonably expect, specific money managers have been driving this bullishness. No Street Capital, managed by Jeff Osher, assembled the most outsized position in Stamps.com Inc. (NASDAQ:STMP). No Street Capital had $41 million invested in the company at the end of the quarter. Eduardo Costa’s Calixto Global Investors also made a $8.2 million investment in the stock during the quarter. The other funds with brand new STMP positions are Greg Eisner’s Engineers Gate Manager, Brian C. Freckmann’s Lyon Street Capital, and Jinghua Yan’s TwinBeech Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Stamps.com Inc. (NASDAQ:STMP) but similarly valued. These stocks are American National Insurance Company (NASDAQ:ANAT), Laureate Education, Inc. (NASDAQ:LAUR), Macquarie Infrastructure Corporation (NYSE:MIC), and LivaNova PLC (NASDAQ:LIVN). This group of stocks’ market caps are similar to STMP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANAT | 14 | 48453 | -2 |

| LAUR | 25 | 197669 | -9 |

| MIC | 30 | 251515 | -4 |

| LIVN | 24 | 235932 | 2 |

| Average | 23.25 | 183392 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $183 million. That figure was $466 million in STMP’s case. Macquarie Infrastructure Corporation (NYSE:MIC) is the most popular stock in this table. On the other hand American National Insurance Company (NASDAQ:ANAT) is the least popular one with only 14 bullish hedge fund positions. Stamps.com Inc. (NASDAQ:STMP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on STMP as the stock returned 52.3% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Stamps.com Inc (NASDAQ:STMP)

Follow Stamps.com Inc (NASDAQ:STMP)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.