How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Soleno Therapeutics, Inc. (NASDAQ:SLNO).

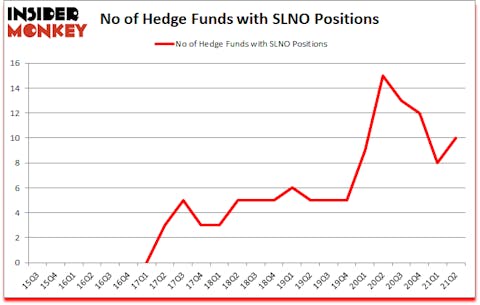

Is Soleno Therapeutics, Inc. (NASDAQ:SLNO) undervalued? Prominent investors were getting more optimistic. The number of bullish hedge fund positions inched up by 2 lately. Soleno Therapeutics, Inc. (NASDAQ:SLNO) was in 10 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 15. Our calculations also showed that SLNO isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 185.4% since March 2017 and outperformed the S&P 500 ETFs by more than 79 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Matthew Strobeck of Birchview Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to analyze the key hedge fund action surrounding Soleno Therapeutics, Inc. (NASDAQ:SLNO).

Do Hedge Funds Think SLNO Is A Good Stock To Buy Now?

At the end of June, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 25% from the previous quarter. On the other hand, there were a total of 15 hedge funds with a bullish position in SLNO a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Nantahala Capital Management held the most valuable stake in Soleno Therapeutics, Inc. (NASDAQ:SLNO), which was worth $11.1 million at the end of the second quarter. On the second spot was Birchview Capital which amassed $1 million worth of shares. Two Sigma Advisors, Renaissance Technologies, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Birchview Capital allocated the biggest weight to Soleno Therapeutics, Inc. (NASDAQ:SLNO), around 0.6% of its 13F portfolio. Nantahala Capital Management is also relatively very bullish on the stock, earmarking 0.32 percent of its 13F equity portfolio to SLNO.

As aggregate interest increased, key money managers have jumped into Soleno Therapeutics, Inc. (NASDAQ:SLNO) headfirst. Renaissance Technologies, assembled the largest position in Soleno Therapeutics, Inc. (NASDAQ:SLNO). Renaissance Technologies had $0.4 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.2 million position during the quarter. The only other fund with a brand new SLNO position is Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Soleno Therapeutics, Inc. (NASDAQ:SLNO) but similarly valued. These stocks are Oblong Inc. (NYSE:OBLG), Corenergy Infrastructure Trust Inc (NYSE:CORR), Heritage Global Inc. (NASDAQ:HGBL), Frequency Electronics, Inc. (NASDAQ:FEIM), Universal Stainless & Alloy Products (NASDAQ:USAP), Affinity Bancshares, Inc. (NASDAQ:AFBI), and Charles & Colvard, Ltd. (NASDAQ:CTHR). All of these stocks’ market caps resemble SLNO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OBLG | 2 | 12656 | -1 |

| CORR | 7 | 3269 | 1 |

| HGBL | 3 | 1208 | 0 |

| FEIM | 2 | 7825 | 0 |

| USAP | 7 | 15790 | 1 |

| AFBI | 2 | 1924 | 1 |

| CTHR | 5 | 8225 | 1 |

| Average | 4 | 7271 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $7 million. That figure was $14 million in SLNO’s case. Corenergy Infrastructure Trust Inc (NYSE:CORR) is the most popular stock in this table. On the other hand Oblong Inc. (NYSE:OBLG) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Soleno Therapeutics, Inc. (NASDAQ:SLNO) is more popular among hedge funds. Our overall hedge fund sentiment score for SLNO is 77. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.7% in 2021 through September 27th and still beat the market by 6.2 percentage points. Unfortunately SLNO wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on SLNO were disappointed as the stock returned -18.2% since the end of the second quarter (through 9/27) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Soleno Therapeutics Inc (NASDAQ:SLNO)

Follow Soleno Therapeutics Inc (NASDAQ:SLNO)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Desalination Companies in the World

- 13 Best Hemp Stocks to Buy Now

- 17 Largest Fintech Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.