Is Shenandoah Telecommunications Company (NASDAQ:SHEN) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

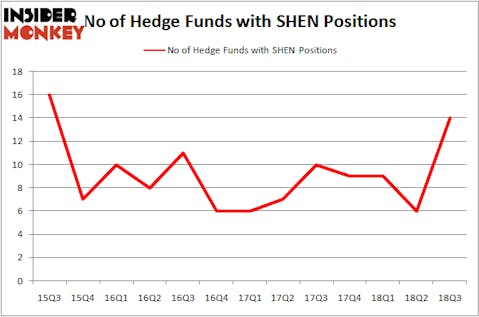

Is Shenandoah Telecommunications Company (NASDAQ:SHEN) a splendid stock to buy now? Prominent investors are turning bullish. The number of bullish hedge fund positions moved up by 8 in recent months. Our calculations also showed that SHEN isn’t among the 30 most popular stocks among hedge funds. SHEN was in 14 hedge funds’ portfolios at the end of September. There were 6 hedge funds in our database with SHEN positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the latest hedge fund action encompassing Shenandoah Telecommunications Company (NASDAQ:SHEN).

How have hedgies been trading Shenandoah Telecommunications Company (NASDAQ:SHEN)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 133% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SHEN over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Shenandoah Telecommunications Company (NASDAQ:SHEN), which was worth $47 million at the end of the third quarter. On the second spot was Millennium Management which amassed $6.9 million worth of shares. Moreover, GAMCO Investors, Arrowstreet Capital, and AQR Capital Management were also bullish on Shenandoah Telecommunications Company (NASDAQ:SHEN), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names have jumped into Shenandoah Telecommunications Company (NASDAQ:SHEN) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most outsized position in Shenandoah Telecommunications Company (NASDAQ:SHEN). Arrowstreet Capital had $3.7 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $2.5 million investment in the stock during the quarter. The following funds were also among the new SHEN investors: Ken Griffin’s Citadel Investment Group, Ken Griffin’s Citadel Investment Group, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s go over hedge fund activity in other stocks similar to Shenandoah Telecommunications Company (NASDAQ:SHEN). We will take a look at Brinker International, Inc. (NYSE:EAT), Euronav NV (NYSE:EURN), Hilltop Holdings Inc. (NYSE:HTH), and Orion Engineered Carbons SA (NYSE:OEC). This group of stocks’ market caps are closest to SHEN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EAT | 26 | 196941 | 6 |

| EURN | 16 | 186535 | -1 |

| HTH | 14 | 136297 | 3 |

| OEC | 23 | 378483 | -1 |

| Average | 19.75 | 224564 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $225 million. That figure was $73 million in SHEN’s case. Brinker International, Inc. (NYSE:EAT) is the most popular stock in this table. On the other hand Hilltop Holdings Inc. (NYSE:HTH) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Shenandoah Telecommunications Company (NASDAQ:SHEN) is even less popular than HTH. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.