Is Nutanix Inc. (NASDAQ:NTNX) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

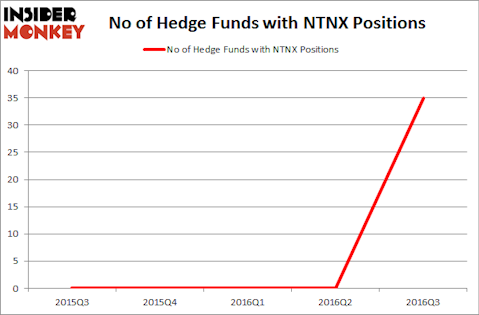

Is Nutanix Inc. (NASDAQ:NTNX) the right investment to pursue these days? Money managers are absolutely in an optimistic mood. The number of bullish hedge fund bets increased by 35 recently. NTNXwas in 35 hedge funds’ portfolios at the end of the third quarter of 2016. There were 0 hedge funds in our database with NTNX positions at the end of the previous quarter, as the company was not yet public. At the end of this article we will also compare NTNX to other stocks including Israel Chemicals Ltd. (NYSE:ICL), Carlyle Group LP (NASDAQ:CG), and Royal Gold, Inc USA) (NASDAQ:RGLD) to get a better sense of its popularity.

Follow Nutanix Inc. (NASDAQ:NTNX)

Follow Nutanix Inc. (NASDAQ:NTNX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

everything possible/Shutterstock.com

Now, let’s take a gander at the latest action regarding Nutanix Inc. (NASDAQ:NTNX).

Hedge fund activity in Nutanix Inc. (NASDAQ:NTNX)

At Q3’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Christopher Lord’s Criterion Capital has the biggest position in Nutanix Inc. (NASDAQ:NTNX), worth close to $9.3 million, corresponding to 0.4% of its total 13F portfolio. Coming in second is Driehaus Capital, led by Richard Driehaus, which holds a $7.5 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish comprise Israel Englander’s Millennium Management, Daniel S. Och’s OZ Management and Spencer M. Waxman’s Shannon River Fund Management. We should note that Shannon River Fund Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, key hedge funds were leading the bulls’ herd. Israel Englander’s Millennium Management was also among the other hedge funds that jumped into the stock. In its latest 13F filing, the fund reported ownership of 200,229 shares valued at $7.41 million. Daniel S. Och’s OZ Management also established a 6.48 million position, having amassed 175,000 shares by the end of the third quarter. The following funds were also among the new NTNX investors: Ken Griffin’s Citadel Investment Group, Anand Parekh’s Alyeska Investment Group and Spencer M. Waxman’s Shannon River Fund Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Nutanix Inc. (NASDAQ:NTNX) but similarly valued. These stocks are Israel Chemicals Ltd. (NYSE:ICL), Carlyle Group LP (NASDAQ:CG), Royal Gold, Inc USA) (NASDAQ:RGLD), and Scotts Miracle-Gro Co (NYSE:SMG). This group of stocks’ market values match NTNX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ICL | 4 | 3555 | 1 |

| CG | 11 | 90845 | 1 |

| RGLD | 19 | 192207 | 2 |

| SMG | 20 | 226331 | -4 |

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $89 million in NTNX’s case. Scotts Miracle-Gro Co (NYSE:SMG) is the most popular stock in this table. On the other hand Israel Chemicals Ltd. (NYSE:ICL) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Nutanix Inc. (NASDAQ:NTNX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.