Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Novocure Ltd (NASDAQ:NVCR) investors should be aware of an increase in hedge fund sentiment lately. There were 6 hedge funds in our database with NVCR positions at the end of the previous quarter. At the end of this article we will also compare NVCR to other stocks including Kelly Services, Inc. (NASDAQ:KELYA), TerraForm Global Inc (NASDAQ:GLBL), and Sandy Spring Bancorp Inc. (NASDAQ:SASR) to get a better sense of its popularity.

Follow Novocure Ltd (NASDAQ:NVCR)

Follow Novocure Ltd (NASDAQ:NVCR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, we’re going to take a gander at the fresh action surrounding Novocure Ltd (NASDAQ:NVCR).

How have hedgies been trading Novocure Ltd (NASDAQ:NVCR)?

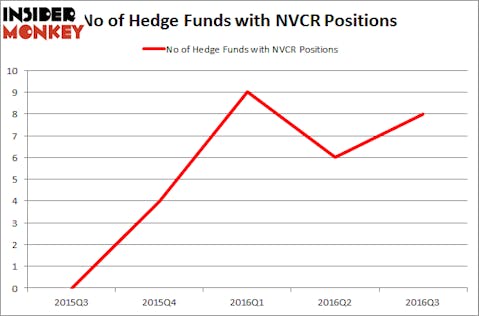

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a jump of 33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NVCR over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Highline Capital Management, led by Jacob Doft, holds the largest position in Novocure Ltd (NASDAQ:NVCR). According to regulatory filings, the fund has a $15.5 million position in the stock, comprising 0.5% of its 13F portfolio. The second most bullish fund manager is Stepstone Group, led by Jose Fernandez, which holds a $15.5 million position; 19.3% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions encompass Justin John Ferayorni’s Tamarack Capital Management, Richard C. Patton’s Courage Capital and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management. We should note that Courage Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key money managers were leading the bulls’ herd. Tamarack Capital Management, led by Justin John Ferayorni, assembled the largest position in Novocure Ltd (NASDAQ:NVCR). The fund reportedly had $6.6 million invested in the company at the end of the quarter. Richard C. Patton’s Courage Capital also made a $4.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s check out hedge fund activity in other stocks similar to Novocure Ltd (NASDAQ:NVCR). These stocks are Kelly Services, Inc. (NASDAQ:KELYA), TerraForm Global Inc (NASDAQ:GLBL), Sandy Spring Bancorp Inc. (NASDAQ:SASR), and ORBCOMM Inc (NASDAQ:ORBC). This group of stocks’ market valuations are closest to NVCR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KELYA | 10 | 37124 | 1 |

| GLBL | 15 | 124310 | -1 |

| SASR | 8 | 19400 | 2 |

| ORBC | 18 | 133227 | 2 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $79 million. That figure was $45 million in NVCR’s case. ORBCOMM Inc (NASDAQ:ORBC) is the most popular stock in this table. On the other hand Sandy Spring Bancorp Inc. (NASDAQ:SASR) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Novocure Ltd (NASDAQ:NVCR) is even less popular than SASR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None