We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Mirati Therapeutics, Inc. (NASDAQ:MRTX).

Mirati Therapeutics, Inc. (NASDAQ:MRTX) has experienced an increase in enthusiasm from smart money in recent months. Our calculations also showed that MRTX isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are assumed to be worthless, old investment tools of yesteryear. While there are greater than 8,000 funds trading today, Our researchers choose to focus on the top tier of this group, approximately 700 funds. Most estimates calculate that this group of people handle the majority of all hedge funds’ total asset base, and by shadowing their unrivaled equity investments, Insider Monkey has come up with various investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a gander at the key hedge fund action regarding Mirati Therapeutics, Inc. (NASDAQ:MRTX).

How are hedge funds trading Mirati Therapeutics, Inc. (NASDAQ:MRTX)?

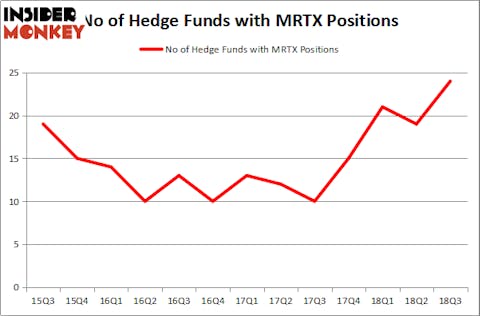

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 26% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in MRTX over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, venBio Select Advisor held the most valuable stake in Mirati Therapeutics, Inc. (NASDAQ:MRTX), which was worth $226 million at the end of the third quarter. On the second spot was Baker Bros. Advisors which amassed $118.4 million worth of shares. Moreover, Cormorant Asset Management, Farallon Capital, and Deerfield Management were also bullish on Mirati Therapeutics, Inc. (NASDAQ:MRTX), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have been driving this bullishness. Brookside Capital, managed by Bain Capital, initiated the most valuable position in Mirati Therapeutics, Inc. (NASDAQ:MRTX). Brookside Capital had $13.8 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also made a $11.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Dmitry Balyasny’s Balyasny Asset Management, and Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Mirati Therapeutics, Inc. (NASDAQ:MRTX) but similarly valued. We will take a look at Royce Value Trust, Inc. (NYSE:RVT), S & T Bancorp Inc (NASDAQ:STBA), Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN), and Cannae Holdings, Inc. (NYSE:CNNE). This group of stocks’ market values match MRTX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RVT | 2 | 13939 | -1 |

| STBA | 6 | 3591 | -1 |

| BHVN | 18 | 198625 | 3 |

| CNNE | 23 | 236768 | -2 |

| Average | 12.25 | 113231 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $113 million. That figure was $661 million in MRTX’s case. Cannae Holdings, Inc. (NYSE:CNNE) is the most popular stock in this table. On the other hand Royce Value Trust, Inc. (NYSE:RVT) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Mirati Therapeutics, Inc. (NASDAQ:MRTX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.