The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Methode Electronics Inc. (NYSE:MEI), and what that likely means for the prospects of the company and its stock.

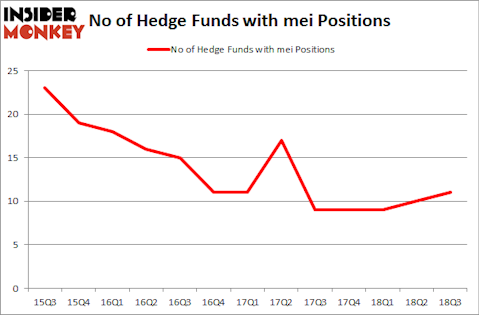

Methode Electronics Inc. (NYSE:MEI) was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. MEI shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. There were 10 hedge funds in our database with MEI holdings at the end of the previous quarter. Our calculations also showed that mei isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most market participants, hedge funds are perceived as underperforming, outdated financial tools of years past. While there are more than 8,000 funds in operation at present, We look at the aristocrats of this group, approximately 700 funds. Most estimates calculate that this group of people oversee most of the hedge fund industry’s total capital, and by tailing their first-class picks, Insider Monkey has deciphered various investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a peek at the latest hedge fund action regarding Methode Electronics Inc. (NYSE:MEI).

What does the smart money think about Methode Electronics Inc. (NYSE:MEI)?

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MEI over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Methode Electronics Inc. (NYSE:MEI), with a stake worth $54.5 million reported as of the end of September. Trailing Royce & Associates was Ariel Investments, which amassed a stake valued at $36.6 million. Renaissance Technologies, AQR Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Gotham Asset Management, managed by Joel Greenblatt, initiated the largest position in Methode Electronics Inc. (NYSE:MEI). Gotham Asset Management had $0.5 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital also made a $0 million investment in the stock during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Methode Electronics Inc. (NYSE:MEI) but similarly valued. These stocks are Nevsun Resources Ltd. (NYSE:NSU), Standex Int’l Corp. (NYSE:SXI), W&T Offshore, Inc. (NYSE:WTI), and BrightSphere Investment Group plc (NYSE:BSIG). This group of stocks’ market values resemble MEI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSU | 15 | 243308 | 7 |

| SXI | 12 | 24985 | -3 |

| WTI | 17 | 152116 | 0 |

| BSIG | 22 | 140776 | 4 |

| Average | 16.5 | 140296 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $129 million in MEI’s case. BrightSphere Investment Group plc (NYSE:BSIG) is the most popular stock in this table. On the other hand Standex Int’l Corp. (NYSE:SXI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Methode Electronics Inc. (NYSE:MEI) is even less popular than SXI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.