After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Loews Corporation (NYSE:L).

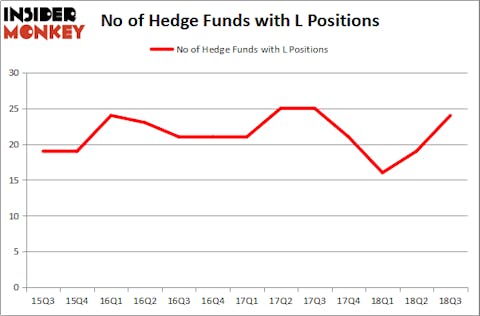

Is Loews Corporation (NYSE:L) a good stock to buy now? Prominent investors are getting more optimistic. The number of long hedge fund positions moved up by 5 recently. Our calculations also showed that L isn’t among the 30 most popular stocks among hedge funds. L was in 24 hedge funds’ portfolios at the end of the third quarter of 2018. There were 19 hedge funds in our database with L positions at the end of the previous quarter.

Today there are several indicators shareholders use to grade their holdings. A couple of the most underrated indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outperform the broader indices by a solid margin (see the details here).

Let’s check out the recent hedge fund action regarding Loews Corporation (NYSE:L).

Hedge fund activity in Loews Corporation (NYSE:L)

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in L over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Loews Corporation (NYSE:L) was held by Diamond Hill Capital, which reported holding $283.6 million worth of stock at the end of September. It was followed by Two Sigma Advisors with a $21.8 million position. Other investors bullish on the company included Millennium Management, Wallace Capital Management, and D E Shaw.

Now, specific money managers have jumped into Loews Corporation (NYSE:L) headfirst. Stevens Capital Management, managed by Matthew Tewksbury, assembled the largest position in Loews Corporation (NYSE:L). Stevens Capital Management had $2.2 million invested in the company at the end of the quarter. George Hall’s Clinton Group also initiated a $1.5 million position during the quarter. The other funds with brand new L positions are George Zweig, Shane Haas and Ravi Chander’s Signition LP, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Bruce Kovner’s Caxton Associates LP.

Let’s check out hedge fund activity in other stocks similar to Loews Corporation (NYSE:L). We will take a look at Tiffany & Co. (NYSE:TIF), Banco de Chile (NYSE:BCH), MSCI Inc (NYSE:MSCI), and ANSYS, Inc. (NASDAQ:ANSS). All of these stocks’ market caps are closest to L’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TIF | 43 | 1695941 | 0 |

| BCH | 2 | 73234 | -2 |

| MSCI | 36 | 768186 | 6 |

| ANSS | 26 | 587440 | 1 |

| Average | 26.75 | 781200 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $781 million. That figure was $423 million in L’s case. Tiffany & Co. (NYSE:TIF) is the most popular stock in this table. On the other hand Banco de Chile (NYSE:BCH) is the least popular one with only 2 bullish hedge fund positions. Loews Corporation (NYSE:L) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TIF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.