Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

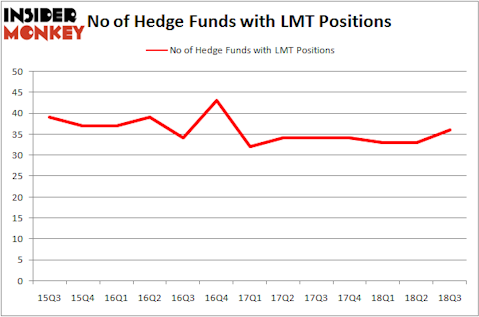

Is Lockheed Martin Corporation (NYSE:LMT) an attractive investment today? Money managers are becoming more confident. The number of long hedge fund positions improved by 3 recently. Our calculations also showed that LMT isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are viewed as unimportant, old financial tools of the past. While there are greater than 8,000 funds trading today, Our experts hone in on the moguls of this club, approximately 700 funds. These hedge fund managers have their hands on bulk of the hedge fund industry’s total asset base, and by following their unrivaled stock picks, Insider Monkey has come up with several investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a gander at the recent hedge fund action regarding Lockheed Martin Corporation (NYSE:LMT).

How are hedge funds trading Lockheed Martin Corporation (NYSE:LMT)?

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from one quarter earlier. By comparison, 34 hedge funds held shares or bullish call options in LMT heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Lockheed Martin Corporation (NYSE:LMT), with a stake worth $497.1 million reported as of the end of September. Trailing Citadel Investment Group was Two Sigma Advisors, which amassed a stake valued at $372.2 million. AQR Capital Management, Adage Capital Management, and Holocene Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Shellback Capital, managed by Doug Gordon, Jon Hilsabeck and Don Jabro, assembled the most valuable position in Lockheed Martin Corporation (NYSE:LMT). Shellback Capital had $35.4 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $30.1 million position during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Richard Driehaus’s Driehaus Capital, and Jeffrey Talpins’s Element Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Lockheed Martin Corporation (NYSE:LMT) but similarly valued. These stocks are Thermo Fisher Scientific Inc. (NYSE:TMO), General Electric Company (NYSE:GE), Booking Holdings Inc. (NASDAQ:BKNG), and Equinor ASA (NYSE:EQNR). This group of stocks’ market values match LMT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TMO | 56 | 4602612 | -3 |

| GE | 46 | 4540328 | 2 |

| BKNG | 68 | 6498246 | -2 |

| EQNR | 12 | 433196 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45.5 hedge funds with bullish positions and the average amount invested in these stocks was $4.02 billion. That figure was $2.02 billion in LMT’s case. Booking Holdings Inc. (NASDAQ:BKNG) is the most popular stock in this table. On the other hand Equinor ASA (NYSE:EQNR) is the least popular one with only 12 bullish hedge fund positions. Lockheed Martin Corporation (NYSE:LMT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BKNG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.