The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st. We at Insider Monkey have made an extensive database of more than 866 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Helmerich & Payne, Inc. (NYSE:HP) based on those filings.

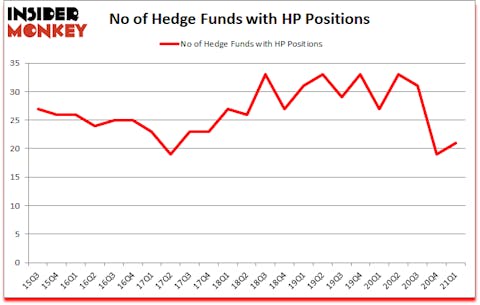

Helmerich & Payne, Inc. (NYSE:HP) was in 21 hedge funds’ portfolios at the end of March. The all time high for this statistic is 33. HP shareholders have witnessed an increase in support from the world’s most elite money managers recently. There were 19 hedge funds in our database with HP positions at the end of the fourth quarter. Our calculations also showed that HP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

At the moment there are a lot of gauges stock market investors put to use to analyze stocks. Some of the less known gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace the broader indices by a healthy amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to take a look at the new hedge fund action surrounding Helmerich & Payne, Inc. (NYSE:HP).

Do Hedge Funds Think HP Is A Good Stock To Buy Now?

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in HP a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, John Overdeck and David Siegel’s Two Sigma Advisors has the most valuable position in Helmerich & Payne, Inc. (NYSE:HP), worth close to $43.8 million, comprising 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Fisher Asset Management, managed by Ken Fisher, which holds a $29.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism consist of Israel Englander’s Millennium Management, Prem Watsa’s Fairfax Financial Holdings and Eric Sprott’s Sprott Asset Management. In terms of the portfolio weights assigned to each position Sprott Asset Management allocated the biggest weight to Helmerich & Payne, Inc. (NYSE:HP), around 0.68% of its 13F portfolio. Fairfax Financial Holdings is also relatively very bullish on the stock, designating 0.52 percent of its 13F equity portfolio to HP.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Scion Asset Management, managed by Michael Burry, assembled the most outsized position in Helmerich & Payne, Inc. (NYSE:HP). Scion Asset Management had $5.4 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also initiated a $1.1 million position during the quarter. The other funds with new positions in the stock are Michael Gelband’s ExodusPoint Capital, Greg Eisner’s Engineers Gate Manager, and Peter Muller’s PDT Partners.

Let’s now take a look at hedge fund activity in other stocks similar to Helmerich & Payne, Inc. (NYSE:HP). We will take a look at Vivint Smart Home, Inc. (NYSE:VVNT), GrowGeneration Corp. (NASDAQ:GRWG), NovaGold Resources Inc. (NYSE:NG), American National Group Inc. (NASDAQ:ANAT), Matson Inc. (NYSE:MATX), Perpetua Resources Corp. (NASDAQ:PPTA), and Opko Health Inc. (NYSE:OPK). This group of stocks’ market valuations match HP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VVNT | 7 | 10266 | -2 |

| GRWG | 18 | 127433 | 0 |

| NG | 15 | 310029 | -3 |

| ANAT | 11 | 55978 | -2 |

| MATX | 19 | 32004 | 5 |

| PPTA | 3 | 167659 | 3 |

| OPK | 15 | 29181 | -1 |

| Average | 12.6 | 104650 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.6 hedge funds with bullish positions and the average amount invested in these stocks was $105 million. That figure was $152 million in HP’s case. Matson Inc. (NYSE:MATX) is the most popular stock in this table. On the other hand Perpetua Resources Corp. (NASDAQ:PPTA) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Helmerich & Payne, Inc. (NYSE:HP) is more popular among hedge funds. Our overall hedge fund sentiment score for HP is 76.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still beat the market by 7.7 percentage points. Unfortunately HP wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on HP were disappointed as the stock returned 7.6% since the end of the first quarter (through 7/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Helmerich & Payne Inc. (NYSE:HP)

Follow Helmerich & Payne Inc. (NYSE:HP)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Companies That Originated In Silicon Valley

- 30 Best Hotels in America in 2021

- 10 Biggest Bitcoin Predictions in 2021

Disclosure: None. This article was originally published at Insider Monkey.