Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 8.7% through October 26th. Forty percent of the S&P 500 constituents were down more than 10%. The average return of a randomly picked stock in the index is -9.5%. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 25 most popular S&P 500 stocks among hedge funds had an average loss of 8.8%. In this article, we will take a look at what hedge funds think about Golar LNG Limited (NASDAQ:GLNG).

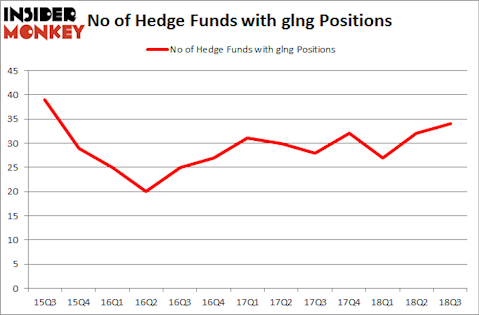

Is Golar LNG Limited (NASDAQ:GLNG) a sound investment today? Money managers are taking an optimistic view. The number of bullish hedge fund positions moved up by 2 in recent months. Our calculations also showed that glng isn’t among the 30 most popular stocks among hedge funds. GLNG was in 34 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with GLNG holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to go over the fresh hedge fund action surrounding Golar LNG Limited (NASDAQ:GLNG).

What does the smart money think about Golar LNG Limited (NASDAQ:GLNG)?

At Q3’s end, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GLNG over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, William B. Gray’s Orbis Investment Management has the most valuable position in Golar LNG Limited (NASDAQ:GLNG), worth close to $162.6 million, amounting to 0.9% of its total 13F portfolio. On Orbis Investment Management’s heels is Blue Mountain Capital, led by Andrew Feldstein and Stephen Siderow, holding a $57.8 million position; the fund has 1% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish contain Christian Leone’s Luxor Capital Group, Ross Turner’s Pelham Capital and Christian Leone’s Luxor Capital Group.

As industrywide interest jumped, specific money managers have jumped into Golar LNG Limited (NASDAQ:GLNG) headfirst. Renaissance Technologies, managed by Jim Simons, established the largest position in Golar LNG Limited (NASDAQ:GLNG). Renaissance Technologies had $10.6 million invested in the company at the end of the quarter. Philip Hempleman’s Ardsley Partners also initiated a $7.6 million position during the quarter. The other funds with brand new GLNG positions are Robert Polak’s Anchor Bolt Capital, David Costen Haley’s HBK Investments, and Ernest Chow and Jonathan Howe’s Sensato Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Golar LNG Limited (NASDAQ:GLNG). We will take a look at Grupo Aeroportuario del Centro Norte, S. A. B. de C. V. (NASDAQ:OMAB), Korn/Ferry International (NYSE:KFY), MakeMyTrip Limited (NASDAQ:MMYT), and Carpenter Technology Corporation (NYSE:CRS). All of these stocks’ market caps are similar to GLNG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMAB | 5 | 38025 | 1 |

| KFY | 20 | 119253 | -1 |

| MMYT | 12 | 57781 | -2 |

| CRS | 14 | 106280 | 0 |

| Average | 12.75 | 80335 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $652 million in GLNG’s case. Korn/Ferry International (NYSE:KFY) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Centro Nort (NASDAQ:OMAB) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Golar LNG Limited (NASDAQ:GLNG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.