A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Ebix Inc (NASDAQ:EBIX).

Is Ebix Inc (NASDAQ:EBIX) a cheap investment today? The smart money is in a bullish mood. The number of bullish hedge fund bets rose by 2 lately. Our calculations also showed that EBIX isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the key hedge fund action surrounding Ebix Inc (NASDAQ:EBIX).

What have hedge funds been doing with Ebix Inc (NASDAQ:EBIX)?

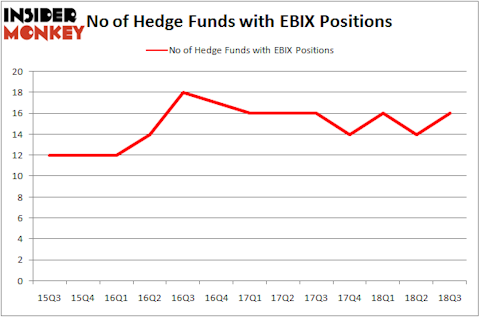

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EBIX over the last 13 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Claus Moller’s P2 Capital Partners has the most valuable position in Ebix Inc (NASDAQ:EBIX), worth close to $65.7 million, accounting for 5.9% of its total 13F portfolio. Sitting at the No. 2 spot is Portolan Capital Management, managed by George McCabe, which holds a $20.5 million position; the fund has 2% of its 13F portfolio invested in the stock. Other peers with similar optimism encompass James A. Mitarotonda’s Barington Capital Group, Chuck Royce’s Royce & Associates and Ken Griffin’s Citadel Investment Group.

Consequently, specific money managers have jumped into Ebix Inc (NASDAQ:EBIX) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most outsized position in Ebix Inc (NASDAQ:EBIX). Marshall Wace LLP had $0.7 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also made a $0.6 million investment in the stock during the quarter. The only other fund with a new position in the stock is Israel Englander’s Millennium Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Ebix Inc (NASDAQ:EBIX) but similarly valued. These stocks are Great Western Bancorp Inc (NYSE:GWB), Iridium Communications Inc. (NASDAQ:IRDM), LifePoint Health, Inc. (NASDAQ:LPNT), and Select Medical Holdings Corporation (NYSE:SEM). All of these stocks’ market caps match EBIX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GWB | 8 | 17358 | 0 |

| IRDM | 11 | 113646 | 1 |

| LPNT | 20 | 232786 | 4 |

| SEM | 19 | 196093 | -1 |

| Average | 14.5 | 139971 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $116 million in EBIX’s case. LifePoint Health, Inc. (NASDAQ:LPNT) is the most popular stock in this table. On the other hand Great Western Bancorp Inc (NYSE:GWB) is the least popular one with only 8 bullish hedge fund positions. Ebix Inc (NASDAQ:EBIX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LPNT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.