We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Bilibili Inc. (NASDAQ:BILI) based on that data.

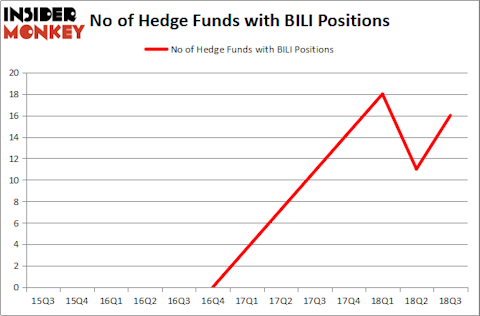

Bilibili Inc. (NASDAQ:BILI) investors should be aware of an increase in enthusiasm from smart money of late. BILI was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 11 hedge funds in our database with BILI holdings at the end of the previous quarter. Our calculations also showed that BILI isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are viewed as unimportant, old investment tools of the past. While there are greater than 8000 funds in operation at present, Our experts hone in on the bigwigs of this club, about 700 funds. These investment experts direct the lion’s share of the smart money’s total capital, and by tailing their first-class investments, Insider Monkey has determined many investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the fresh hedge fund action regarding Bilibili Inc. (NASDAQ:BILI).

How have hedgies been trading Bilibili Inc. (NASDAQ:BILI)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 45% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in BILI over the last 13 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Tiger Global Management LLC, managed by Chase Coleman, holds the most valuable position in Bilibili Inc. (NASDAQ:BILI). Tiger Global Management LLC has a $78.7 million position in the stock, comprising 0.4% of its 13F portfolio. Coming in second is Josh Resnick of Jericho Capital Asset Management, with a $45.1 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism encompass Run Ye, Junji Takegami and Hoyon Hwang’s Tiger Pacific Capital, David Fiszel’s Honeycomb Asset Management and Louis Bacon’s Moore Global Investments.

As industrywide interest jumped, key money managers were breaking ground themselves. Honeycomb Asset Management, managed by David Fiszel, created the largest position in Bilibili Inc. (NASDAQ:BILI). Honeycomb Asset Management had $20.2 million invested in the company at the end of the quarter. Louis Bacon’s Moore Global Investments also initiated a $12.8 million position during the quarter. The other funds with brand new BILI positions are Steve Cohen’s Point72 Asset Management, Ken Griffin’s Citadel Investment Group, and Daniel S. Och’s OZ Management.

Let’s now take a look at hedge fund activity in other stocks similar to Bilibili Inc. (NASDAQ:BILI). These stocks are MyoKardia, Inc. (NASDAQ:MYOK), The Descartes Systems Group Inc (NASDAQ:DSGX), ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD), and AMN Healthcare Services Inc (NYSE:AMN). This group of stocks’ market values match BILI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYOK | 22 | 670244 | 2 |

| DSGX | 9 | 84748 | 2 |

| ACAD | 19 | 809984 | 1 |

| AMN | 15 | 50566 | 5 |

| Average | 16.25 | 403886 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $404 million. That figure was $225 million in BILI’s case. MyoKardia, Inc. (NASDAQ:MYOK) is the most popular stock in this table. On the other hand The Descartes Systems Group Inc (NASDAQ:DSGX) is the least popular one with only 9 bullish hedge fund positions. Bilibili Inc. (NASDAQ:BILI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MYOK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.