Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

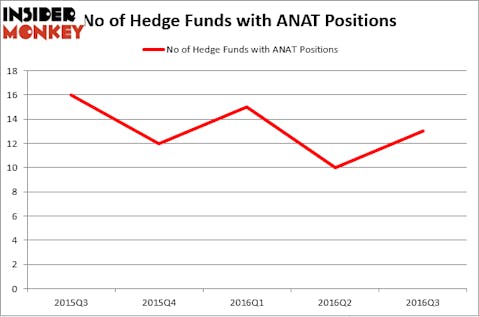

American National Insurance Company (NASDAQ:ANAT) was in 13 hedge funds’ portfolios at the end of September. ANAT has experienced an increase in hedge fund interest in recent months. There were 10 hedge funds in our database with ANAT positions at the end of the previous quarter. At the end of this article we will also compare ANAT to other stocks including Cabot Corp (NYSE:CBT), Outfront Media Inc (NYSE:OUT), and Rayonier Inc. (NYSE:RYN) to get a better sense of its popularity.

Follow American National Insurance Co (NASDAQ:ANAT)

Follow American National Insurance Co (NASDAQ:ANAT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

ilikestudio/Shutterstock.com

Hedge fund activity in American National Insurance Company (NASDAQ:ANAT)

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a gain of 30% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in ANAT over the last 5 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, has the number one position in American National Insurance Company (NASDAQ:ANAT), worth close to $19 million. On Renaissance Technologies’ heels is AQR Capital Management, led by Cliff Asness, which holds a $3.2 million position. Some other hedge funds and institutional investors with similar optimism include Roger Ibbotson’s Zebra Capital Management, Ken Griffin’s Citadel Investment Group and Brian Taylor’s Pine River Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.