We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Universal Health Services, Inc. (NYSE:UHS).

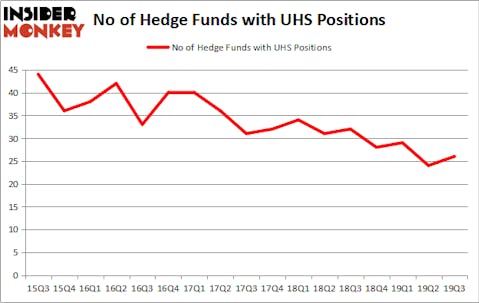

Universal Health Services, Inc. (NYSE:UHS) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that UHS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Larry Robbins of Glenview Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the latest hedge fund action encompassing Universal Health Services, Inc. (NYSE:UHS).

What have hedge funds been doing with Universal Health Services, Inc. (NYSE:UHS)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the second quarter of 2019. By comparison, 32 hedge funds held shares or bullish call options in UHS a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of Universal Health Services, Inc. (NYSE:UHS), with a stake worth $130.6 million reported as of the end of September. Trailing AQR Capital Management was Glenview Capital, which amassed a stake valued at $110 million. Camber Capital Management, Winton Capital Management, and Sirios Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Camber Capital Management allocated the biggest weight to Universal Health Services, Inc. (NYSE:UHS), around 3.91% of its portfolio. Sivik Global Healthcare is also relatively very bullish on the stock, designating 3.75 percent of its 13F equity portfolio to UHS.

As aggregate interest increased, specific money managers have been driving this bullishness. Laurion Capital Management, managed by Benjamin A. Smith, established the most outsized position in Universal Health Services, Inc. (NYSE:UHS). Laurion Capital Management had $3.6 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also made a $1.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Lee Ainslie’s Maverick Capital, Michael Gelband’s ExodusPoint Capital, and Ray Dalio’s Bridgewater Associates.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Universal Health Services, Inc. (NYSE:UHS) but similarly valued. We will take a look at Vistra Energy Corp. (NYSE:VST), Fortinet Inc (NASDAQ:FTNT), Genmab A/S (NASDAQ:GMAB), and International Flavors & Fragrances Inc (NYSE:IFF). This group of stocks’ market caps are closest to UHS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VST | 42 | 2382348 | 3 |

| FTNT | 38 | 1187931 | 4 |

| GMAB | 10 | 136229 | 10 |

| IFF | 19 | 202887 | 1 |

| Average | 27.25 | 977349 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $977 million. That figure was $563 million in UHS’s case. Vistra Energy Corp. (NYSE:VST) is the most popular stock in this table. On the other hand Genmab A/S (NASDAQ:GMAB) is the least popular one with only 10 bullish hedge fund positions. Universal Health Services, Inc. (NYSE:UHS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately UHS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); UHS investors were disappointed as the stock returned -6.2% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.