The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Tootsie Roll Industries, Inc. (NYSE:TR) based on those filings.

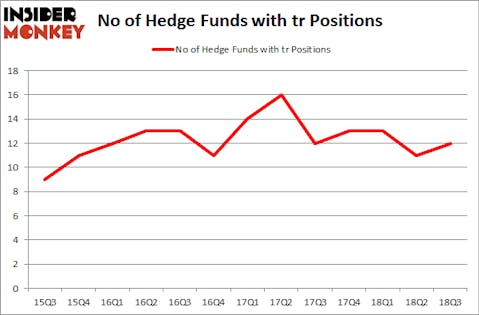

Is Tootsie Roll Industries, Inc. (NYSE:TR) going to take off soon? Prominent investors are becoming hopeful. The number of bullish hedge fund positions increased by 1 recently. Our calculations also showed that tr isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the fresh hedge fund action surrounding Tootsie Roll Industries, Inc. (NYSE:TR).

What does the smart money think about Tootsie Roll Industries, Inc. (NYSE:TR)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TR over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GAMCO Investors held the most valuable stake in Tootsie Roll Industries, Inc. (NYSE:TR), which was worth $29.9 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $25.7 million worth of shares. Moreover, Renaissance Technologies, Prospector Partners, and Wallace Capital Management were also bullish on Tootsie Roll Industries, Inc. (NYSE:TR), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, created the most outsized position in Tootsie Roll Industries, Inc. (NYSE:TR). Millennium Management had $1.3 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $0.2 million position during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Tootsie Roll Industries, Inc. (NYSE:TR) but similarly valued. We will take a look at 21Vianet Group Inc (NASDAQ:VNET), Alder Biopharmaceuticals Inc (NASDAQ:ALDR), The Buckle, Inc. (NYSE:BKE), and Chase Corporation (NYSE:CCF). This group of stocks’ market values match TR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNET | 13 | 26700 | 2 |

| ALDR | 16 | 359698 | -3 |

| BKE | 15 | 29553 | 3 |

| CCF | 6 | 90698 | 1 |

| Average | 12.5 | 126662 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $127 million. That figure was $74 million in TR’s case. Alder Biopharmaceuticals Inc (NASDAQ:ALDR) is the most popular stock in this table. On the other hand Chase Corporation (NYSE:CCF) is the least popular one with only 6 bullish hedge fund positions. Tootsie Roll Industries, Inc. (NYSE:TR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ALDR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.