There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze The RMR Group Inc (NASDAQ:RMR) .

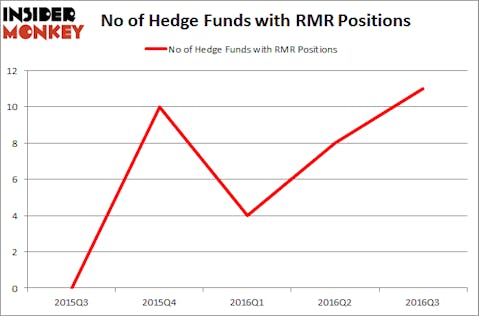

The RMR Group Inc (NASDAQ:RMR) has seen an increase in enthusiasm from smart money lately. There were 11 hedge funds in our database with RMR positions at the end of September, up considerably from the number at the end of June. At the end of this article we will also compare RMR to other stocks including GasLog Ltd (NYSE:GLOG), Atkore International Group Inc (NYSE:ATKR), and Agree Realty Corporation (NYSE:ADC) to get a better sense of its popularity.

Follow Rmr Real Estate Fund (NASDAQ:RMR)

Follow Rmr Real Estate Fund (NASDAQ:RMR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

photofriday/Shutterstock.com

Now, let’s check out the fresh action encompassing The RMR Group Inc (NASDAQ:RMR).

Hedge fund activity in The RMR Group Inc (NASDAQ:RMR)

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 38% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RMR over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Engine Capital, led by Arnaud Ajdler, holds the most valuable position in The RMR Group Inc (NASDAQ:RMR) . Engine Capital has a $10.1 million position in the stock, comprising 9.3% of its 13F portfolio. On Engine Capital’s heels is Hawk Ridge Management, led by David Brown, which holds a $8.7 million position; the fund has 4.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions consist of Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Chuck Royce’s Royce & Associates and Renaissance Technologies, one of the largest hedge funds in the world. We should note that Engine Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key hedge funds were breaking ground themselves. HighVista Strategies, led by Andre F. Perold, created the most valuable position in The RMR Group Inc (NASDAQ:RMR) . HighVista Strategies had $1.3 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also initiated a $0.2 million position during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks similar to The RMR Group Inc (NASDAQ:RMR) . These stocks are GasLog Ltd (NYSE:GLOG), Atkore International Group Inc (NYSE:ATKR), Agree Realty Corporation (NYSE:ADC), and Gibraltar Industries Inc (NASDAQ:ROCK). This group of stocks’ market valuations are closest to RMR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLOG | 9 | 41618 | 0 |

| ATKR | 10 | 99817 | -2 |

| ADC | 13 | 39453 | 3 |

| ROCK | 23 | 144533 | 2 |

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $81 million. That figure was $27 million in RMR’s case. Gibraltar Industries Inc (NASDAQ:ROCK) is the most popular stock in this table. On the other hand GasLog Ltd (NYSE:GLOG) is the least popular one with only 9 bullish hedge fund positions. The RMR Group Inc (NASDAQ:RMR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ROCK might be a better candidate to consider taking a long position in.

Disclosure: None