Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018. This means hedge funds that are allocating a higher percentage of their portfolio to small-cap stocks were probably underperforming the market. However, this also means that as small-cap stocks start to mean revert, these hedge funds will start delivering better returns than the S&P 500 Index funds. In this article, we will take a look at what hedge funds think about Summit Hotel Properties Inc (NYSE:INN).

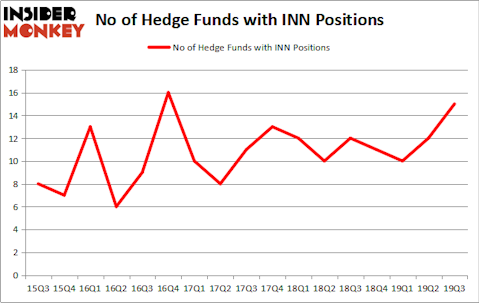

Is Summit Hotel Properties Inc (NYSE:INN) a first-rate investment now? Investors who are in the know are in a bullish mood. The number of bullish hedge fund bets improved by 3 in recent months. Our calculations also showed that INN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). INN was in 15 hedge funds’ portfolios at the end of the third quarter of 2019. There were 12 hedge funds in our database with INN holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a lot of formulas shareholders employ to evaluate stocks. Some of the less utilized formulas are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the best investment managers can trounce the S&P 500 by a healthy margin (see the details here).

Dmitry Balyasny of Balyasny Asset Managemnet

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December we recommended Adams Energy based on an under-the-radar fund manager’s investor letter and the stock gained 20 percent. We’re going to take a peek at the fresh hedge fund action surrounding Summit Hotel Properties Inc (NYSE:INN).

What does smart money think about Summit Hotel Properties Inc (NYSE:INN)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 25% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in INN over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Summit Hotel Properties Inc (NYSE:INN), which was worth $11.5 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $7.9 million worth of shares. Driehaus Capital, Millennium Management, and Balyasny Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Driehaus Capital allocated the biggest weight to Summit Hotel Properties Inc (NYSE:INN), around 0.11% of its 13F portfolio. Ellington is also relatively very bullish on the stock, dishing out 0.06 percent of its 13F equity portfolio to INN.

As industrywide interest jumped, key money managers have been driving this bullishness. Driehaus Capital, managed by Richard Driehaus, assembled the biggest position in Summit Hotel Properties Inc (NYSE:INN). Driehaus Capital had $3.4 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $2 million position during the quarter. The other funds with brand new INN positions are Mike Vranos’s Ellington, Michael Gelband’s ExodusPoint Capital, and Matthew Tewksbury’s Stevens Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Summit Hotel Properties Inc (NYSE:INN) but similarly valued. These stocks are Guess’, Inc. (NYSE:GES), Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC), OceanFirst Financial Corp. (NASDAQ:OCFC), and GreenSky, Inc. (NASDAQ:GSKY). This group of stocks’ market values resemble INN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GES | 17 | 84122 | 2 |

| TRHC | 10 | 58647 | 3 |

| OCFC | 13 | 66418 | 0 |

| GSKY | 15 | 55125 | -5 |

| Average | 13.75 | 66078 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $31 million in INN’s case. Guess’, Inc. (NYSE:GES) is the most popular stock in this table. On the other hand Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC) is the least popular one with only 10 bullish hedge fund positions. Summit Hotel Properties Inc (NYSE:INN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on INN, though not to the same extent, as the stock returned 6.1% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.