The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Smith & Wesson Holding Corp (NASDAQ:SWHC).

Smith & Wesson Holding Corp (NASDAQ:SWHC) has experienced an increase in activity from the world’s largest hedge funds recently. At the end of this article we will also compare SWHC to other stocks including Halyard Health Inc (NYSE:HYH), HubSpot Inc (NYSE:HUBS), and Proto Labs Inc (NYSE:PRLB) to get a better sense of its popularity.

Follow Smith & Wesson Brands Inc. (NASDAQ:SWBI)

Follow Smith & Wesson Brands Inc. (NASDAQ:SWBI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

With all of this in mind, we’re going to review the latest action surrounding Smith & Wesson Holding Corp (NASDAQ:SWHC).

How are hedge funds trading Smith & Wesson Holding Corp (NASDAQ:SWHC)?

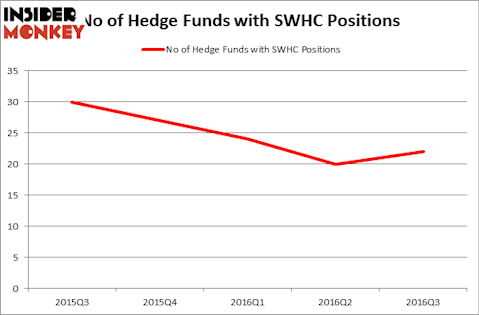

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock,up 10% from the previous quarter. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the most valuable position in Smith & Wesson Holding Corp (NASDAQ:SWHC), worth close to $50.1 million and comprising 0.2% of its total 13F portfolio. The second most bullish fund manager is Gotham Asset Management, led by Joel Greenblatt, holding a $21.4 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism encompass Israel Englander’s Millennium Management, Cliff Asness’s AQR Capital Management and John Overdeck and David Siegel’s Two Sigma Advisors.