The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider SailPoint Technologies Holdings, Inc. (NYSE:SAIL) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

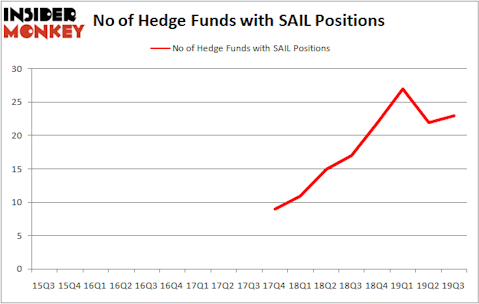

Is SailPoint Technologies Holdings, Inc. (NYSE:SAIL) a buy right now? The smart money is in an optimistic mood. The number of long hedge fund positions moved up by 1 lately. Our calculations also showed that SAIL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are several formulas stock traders can use to analyze their stock investments. A couple of the best formulas are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the S&P 500 by a healthy margin (see the details here).

Gil Simon of SoMa Equity Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s go over the new hedge fund action encompassing SailPoint Technologies Holdings, Inc. (NYSE:SAIL).

Hedge fund activity in SailPoint Technologies Holdings, Inc. (NYSE:SAIL)

Heading into the fourth quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the second quarter of 2019. On the other hand, there were a total of 17 hedge funds with a bullish position in SAIL a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, SoMa Equity Partners was the largest shareholder of SailPoint Technologies Holdings, Inc. (NYSE:SAIL), with a stake worth $74.8 million reported as of the end of September. Trailing SoMa Equity Partners was Point72 Asset Management, which amassed a stake valued at $31.9 million. Rubric Capital Management, Citadel Investment Group, and RGM Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position SoMa Equity Partners allocated the biggest weight to SailPoint Technologies Holdings, Inc. (NYSE:SAIL), around 5.28% of its 13F portfolio. Rubric Capital Management is also relatively very bullish on the stock, earmarking 2.57 percent of its 13F equity portfolio to SAIL.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. RGM Capital, managed by Robert G. Moses, initiated the biggest position in SailPoint Technologies Holdings, Inc. (NYSE:SAIL). RGM Capital had $23 million invested in the company at the end of the quarter. Eric Bannasch’s Cadian Capital also made a $8.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Neal Nathani and Darren Dinneen’s Totem Point Management, Jeffrey Talpins’s Element Capital Management, and Michael Hintze’s CQS Cayman LP.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as SailPoint Technologies Holdings, Inc. (NYSE:SAIL) but similarly valued. These stocks are Banco Macro SA (NYSE:BMA), Meredith Corporation (NYSE:MDP), Kaman Corporation (NYSE:KAMN), and Papa John’s International, Inc. (NASDAQ:PZZA). This group of stocks’ market caps are similar to SAIL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMA | 11 | 95493 | 1 |

| MDP | 19 | 274737 | 8 |

| KAMN | 19 | 248406 | 5 |

| PZZA | 24 | 382533 | 2 |

| Average | 18.25 | 250292 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $250 million. That figure was $226 million in SAIL’s case. Papa John’s International, Inc. (NASDAQ:PZZA) is the most popular stock in this table. On the other hand Banco Macro SA (NYSE:BMA) is the least popular one with only 11 bullish hedge fund positions. SailPoint Technologies Holdings, Inc. (NYSE:SAIL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on SAIL as the stock returned 33.9% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.