Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

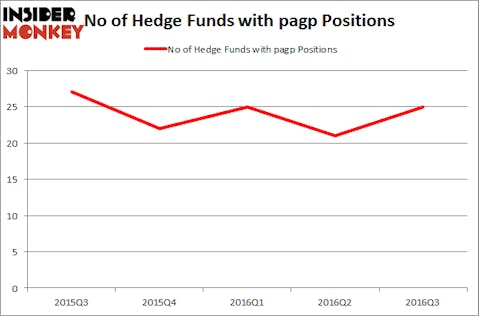

Plains GP Holdings LP (NYSE:PAGP) was in 25 hedge funds’ portfolios at the end of September. PAGP has experienced an increase in activity from the world’s largest hedge funds lately. There were 21 hedge funds in our database with PAGP positions at the end of the previous quarter. At the end of this article we will also compare PAGP to other stocks including Sociedad Quimica y Minera (ADR) (NYSE:SQM), 58.com Inc (ADR) (NYSE:WUBA), and Zillow Inc (NASDAQ:Z) to get a better sense of its popularity.

Follow Plains Gp Holdings Lp (NASDAQ:PAGP)

Follow Plains Gp Holdings Lp (NASDAQ:PAGP)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

PLRANG ART/Shutterstock.com

Keeping this in mind, let’s go over the latest action regarding Plains GP Holdings LP (NYSE:PAGP).

How have hedgies been trading Plains GP Holdings LP (NYSE:PAGP)?

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a boost of 19% from the previous quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Iridian Asset Management, run by David Cohen and Harold Levy, holds the biggest position in Plains GP Holdings LP (NYSE:PAGP). According to regulatory filings, the fund has a $160.9 million position in the stock, comprising 1.4% of its 13F portfolio. The second largest stake is held by James Dondero of Highland Capital Management, with a $34.4 million position; 1.1% of its 13F portfolio is allocated to the stock. Some other professional money managers that hold long positions encompass Clint Carlson’s Carlson Capital, Alec Litowitz and Ross Laser’s Magnetar Capital and Steve Cohen’s Point72 Asset Management.