In this article you are going to find out whether hedge funds think PagerDuty, Inc. (NYSE:PD) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

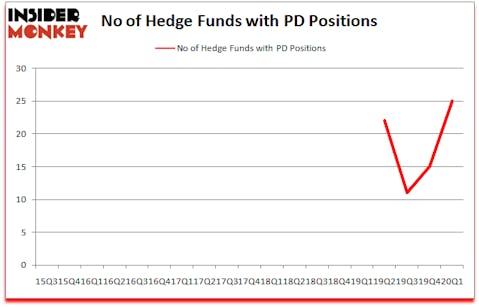

Is PagerDuty, Inc. (NYSE:PD) an exceptional investment right now? Investors who are in the know are becoming hopeful. The number of long hedge fund bets moved up by 10 recently. Our calculations also showed that PD isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). PD was in 25 hedge funds’ portfolios at the end of the first quarter of 2020. There were 15 hedge funds in our database with PD holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are several tools stock traders can use to grade publicly traded companies. A duo of the most underrated tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top investment managers can outclass the market by a very impressive margin (see the details here).

David Atterbury of Whetstone Capital Advisors

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like these. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a glance at the recent hedge fund action surrounding PagerDuty, Inc. (NYSE:PD).

How have hedgies been trading PagerDuty, Inc. (NYSE:PD)?

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 67% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in PD over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Bares Capital Management held the most valuable stake in PagerDuty, Inc. (NYSE:PD), which was worth $9.7 million at the end of the third quarter. On the second spot was Whetstone Capital Advisors which amassed $9.5 million worth of shares. Renaissance Technologies, Millennium Management, and Lakewood Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Whetstone Capital Advisors allocated the biggest weight to PagerDuty, Inc. (NYSE:PD), around 3.26% of its 13F portfolio. Kayak Investment Partners is also relatively very bullish on the stock, earmarking 0.55 percent of its 13F equity portfolio to PD.

Now, some big names have been driving this bullishness. Bares Capital Management, managed by Brian Bares, established the most valuable position in PagerDuty, Inc. (NYSE:PD). Bares Capital Management had $9.7 million invested in the company at the end of the quarter. David Atterbury’s Whetstone Capital Advisors also made a $9.5 million investment in the stock during the quarter. The following funds were also among the new PD investors: Renaissance Technologies, Anthony Bozza’s Lakewood Capital Management, and Brandon Haley’s Holocene Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as PagerDuty, Inc. (NYSE:PD) but similarly valued. These stocks are Kulicke and Soffa Industries Inc. (NASDAQ:KLIC), Cortexyme, Inc. (NASDAQ:CRTX), AtriCure Inc. (NASDAQ:ATRC), and Green Dot Corporation (NYSE:GDOT). This group of stocks’ market caps are similar to PD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KLIC | 19 | 231499 | -3 |

| CRTX | 6 | 14838 | 5 |

| ATRC | 20 | 185400 | 2 |

| GDOT | 22 | 376626 | -1 |

| Average | 16.75 | 202091 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $202 million. That figure was $54 million in PD’s case. Green Dot Corporation (NYSE:GDOT) is the most popular stock in this table. On the other hand Cortexyme, Inc. (NASDAQ:CRTX) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks PagerDuty, Inc. (NYSE:PD) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 13.9% in 2020 through June 10th but still managed to beat the market by 14.2 percentage points. Hedge funds were also right about betting on PD as the stock returned 53.2% so far in Q2 (through June 10th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Pagerduty Inc. (NYSE:PD)

Follow Pagerduty Inc. (NYSE:PD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.