Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

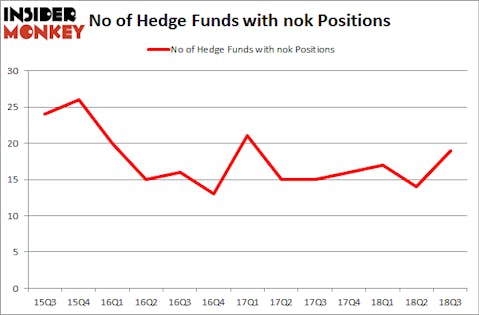

Nokia Corporation (NYSE:NOK) has seen an increase in enthusiasm from smart money lately. NOK was in 19 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with NOK positions at the end of the previous quarter. Our calculations also showed that nok isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the latest hedge fund action encompassing Nokia Corporation (NYSE:NOK).

Hedge fund activity in Nokia Corporation (NYSE:NOK)

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 36% from the second quarter of 2018. By comparison, 16 hedge funds held shares or bullish call options in NOK heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John A. Levin’s Levin Capital Strategies has the most valuable position in Nokia Corporation (NYSE:NOK), worth close to $195.9 million, amounting to 3.4% of its total 13F portfolio. The second largest stake is held by Ariel Investments, led by John W. Rogers, holding a $134.7 million position; 1.5% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ross Margolies’s Stelliam Investment Management and Ken Griffin’s Citadel Investment Group.

As aggregate interest increased, key hedge funds were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, created the biggest position in Nokia Corporation (NYSE:NOK). Alyeska Investment Group had $26.2 million invested in the company at the end of the quarter. Philip Hempleman’s Ardsley Partners also initiated a $5.6 million position during the quarter. The other funds with brand new NOK positions are Joe DiMenna’s ZWEIG DIMENNA PARTNERS, Larry Foley and Paul Farrell’s Bronson Point Partners, and Louis Bacon’s Moore Global Investments.

Let’s go over hedge fund activity in other stocks similar to Nokia Corporation (NYSE:NOK). These stocks are Sempra Energy (NYSE:SRE), Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), SunTrust Banks, Inc. (NYSE:STI), and TE Connectivity Ltd. (NYSE:TEL). This group of stocks’ market values resemble NOK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRE | 33 | 2912686 | 11 |

| ALXN | 37 | 2808171 | -6 |

| STI | 22 | 319050 | -3 |

| TEL | 30 | 1069097 | 1 |

| Average | 30.5 | 1777251 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.78 billion. That figure was $521 million in NOK’s case. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is the most popular stock in this table. On the other hand SunTrust Banks, Inc. (NYSE:STI) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Nokia Corporation (NYSE:NOK) is even less popular than STI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.