The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider NII Holdings, Inc. (NASDAQ:NIHD) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

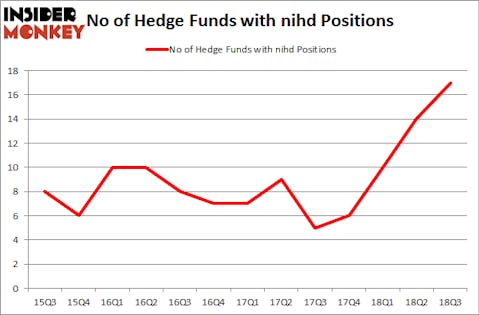

NII Holdings, Inc. (NASDAQ:NIHD) has experienced an increase in support from the world’s most elite money managers recently. NIHD was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with NIHD positions at the end of the previous quarter. Our calculations also showed that nihd isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are several tools stock market investors have at their disposal to assess publicly traded companies. Two of the most underrated tools are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can outpace the market by a solid amount (see the details here).

Let’s view the key hedge fund action encompassing NII Holdings, Inc. (NASDAQ:NIHD).

How are hedge funds trading NII Holdings, Inc. (NASDAQ:NIHD)?

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 21% from the second quarter of 2018. On the other hand, there were a total of 6 hedge funds with a bullish position in NIHD at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in NII Holdings, Inc. (NASDAQ:NIHD) was held by 683 Capital Partners, which reported holding $82.3 million worth of stock at the end of September. It was followed by Point State Capital with a $25.3 million position. Other investors bullish on the company included Empyrean Capital Partners, Taconic Capital, and Renaissance Technologies.

Now, key money managers were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized position in NII Holdings, Inc. (NASDAQ:NIHD). Point72 Asset Management had $3.5 million invested in the company at the end of the quarter. Nehal Chopra’s Ratan Capital Group also made a $1.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Sander Gerber’s Hudson Bay Capital Management, Andrew Weiss’s Weiss Asset Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to NII Holdings, Inc. (NASDAQ:NIHD). These stocks are Bank of Marin Bancorp (NASDAQ:BMRC), Peapack-Gladstone Financial Corp (NASDAQ:PGC), First Trust MLP and Energy Income Fund (NYSE:FEI), and Nuveen Intermediate Duration Municipal Term Fund (NYSE:NID). All of these stocks’ market caps match NIHD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMRC | 7 | 24451 | 2 |

| PGC | 15 | 92823 | 1 |

| FEI | 2 | 591 | 1 |

| NID | 2 | 1946 | -1 |

| Average | 6.5 | 29953 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $161 million in NIHD’s case. Peapack-Gladstone Financial Corp (NASDAQ:PGC) is the most popular stock in this table. On the other hand First Trust MLP and Energy Income Fund (NYSE:FEI) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks NII Holdings, Inc. (NASDAQ:NIHD) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.