How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Honda Motor Co Ltd (ADR) (NYSE:HMC) .

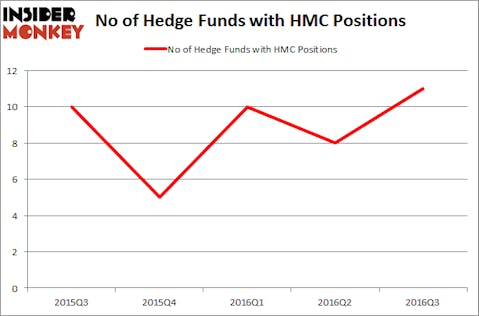

Is Honda Motor Co Ltd (ADR) (NYSE:HMC) a bargain? Prominent investors are indeed buying. The number of bullish hedge fund bets swelled by 3 in recent months. HMC was in 11 hedge funds’ portfolios at the end of September. There were 8 hedge funds in our database with HMC holdings at the end of the previous quarter. At the end of this article we will also compare HMC to other stocks including Caterpillar Inc. (NYSE:CAT), Kinder Morgan Inc (NYSE:KMI), and Banco Santander (Brasil) SA (ADR) (NYSE:BSBR) to get a better sense of its popularity.

Follow Honda Motor Ltd (NYSE:HMC)

Follow Honda Motor Ltd (NYSE:HMC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Photographee.eu/Shutterstock.com

With all of this in mind, we’re going to analyze the latest action encompassing Honda Motor Co Ltd (ADR) (NYSE:HMC).

How are hedge funds trading Honda Motor Co Ltd (ADR) (NYSE:HMC)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 38% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HMC over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world, holds the most valuable position in Honda Motor Co Ltd (ADR) (NYSE:HMC). Renaissance Technologies has a $103.7 million position in the stock, comprising 0.2% of its 13F portfolio. On Renaissance Technologies’s heels is Orbis Investment Management, led by William B. Gray, which holds a $14.8 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions consist of Paul Marshall and Ian Wace’s Marshall Wace LLP, Israel Englander’s Millennium Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. We should note that Orbis Investment Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key hedge funds have jumped into Honda Motor Co Ltd (ADR) (NYSE:HMC) headfirst. Orbis Investment Management, led by William B. Gray, initiated the most valuable position in Honda Motor Co Ltd (ADR) (NYSE:HMC). Orbis Investment Management had $14.8 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $12.1 million position during the quarter. The other funds with brand new HMC positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks similar to Honda Motor Co Ltd (ADR) (NYSE:HMC). These stocks are Caterpillar Inc. (NYSE:CAT), Kinder Morgan Inc (NYSE:KMI), Banco Santander (Brasil) SA (ADR) (NYSE:BSBR), and Lloyds Banking Group PLC (ADR) (NYSE:LYG). All of these stocks’ market caps match HMC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAT | 32 | 1460921 | 1 |

| KMI | 68 | 2836616 | 15 |

| BSBR | 5 | 47432 | 5 |

| LYG | 11 | 334783 | 1 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1170 million. That figure was $150 million in HMC’s case. Kinder Morgan Inc (NYSE:KMI) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (ADR) (NYSE:BSBR) is the least popular one with only 5 bullish hedge fund positions. Honda Motor Co Ltd (ADR) (NYSE:HMC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KMI might be a better candidate to consider taking a long position in.

Suggested Articles:

Top Selling Cigarettes In The World

Best Places To Get Married In Las Vegas

Best Selling Consumer Products In The USA

Disclosure: None