The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Hawaiian Holdings, Inc. (NASDAQ:HA) based on those filings.

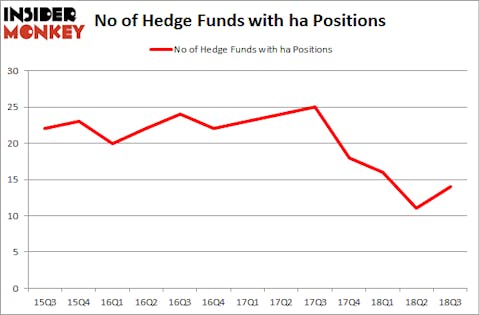

Is Hawaiian Holdings, Inc. (NASDAQ:HA) a buy, sell, or hold? The smart money is becoming hopeful. The number of long hedge fund positions improved by 3 recently. Our calculations also showed that ha isn’t among the 30 most popular stocks among hedge funds. HA was in 14 hedge funds’ portfolios at the end of the third quarter of 2018. There were 11 hedge funds in our database with HA holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the new hedge fund action surrounding Hawaiian Holdings, Inc. (NASDAQ:HA).

Hedge fund activity in Hawaiian Holdings, Inc. (NASDAQ:HA)

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in HA over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Hawaiian Holdings, Inc. (NASDAQ:HA) was held by Royce & Associates, which reported holding $40.2 million worth of stock at the end of September. It was followed by Third Avenue Management with a $23 million position. Other investors bullish on the company included Two Sigma Advisors, Renaissance Technologies, and Water Street Capital.

As industrywide interest jumped, specific money managers have jumped into Hawaiian Holdings, Inc. (NASDAQ:HA) headfirst. Renaissance Technologies, managed by Jim Simons, created the biggest position in Hawaiian Holdings, Inc. (NASDAQ:HA). Renaissance Technologies had $12.6 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $3.1 million position during the quarter. The other funds with brand new HA positions are Israel Englander’s Millennium Management, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Hawaiian Holdings, Inc. (NASDAQ:HA) but similarly valued. These stocks are NetScout Systems, Inc. (NASDAQ:NTCT), Summit Materials Inc (NYSE:SUM), Taylor Morrison Home Corp (NYSE:TMHC), and TopBuild Corp (NYSE:BLD). All of these stocks’ market caps are similar to HA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTCT | 12 | 105716 | -2 |

| SUM | 21 | 570012 | -6 |

| TMHC | 21 | 398861 | 0 |

| BLD | 18 | 142394 | 5 |

| Average | 18 | 304246 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $304 million. That figure was $114 million in HA’s case. Summit Materials Inc (NYSE:SUM) is the most popular stock in this table. On the other hand NetScout Systems, Inc. (NASDAQ:NTCT) is the least popular one with only 12 bullish hedge fund positions. Hawaiian Holdings, Inc. (NASDAQ:HA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SUM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.