A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Graham Holdings Co (NYSE:GHC).

Is Graham Holdings Co (NYSE:GHC) worth your attention right now? Money managers are getting more bullish. The number of long hedge fund bets advanced by 2 lately. Our calculations also showed that GHC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Mason Hawkins of Southeastern Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the recent hedge fund action surrounding Graham Holdings Co (NYSE:GHC).

How are hedge funds trading Graham Holdings Co (NYSE:GHC)?

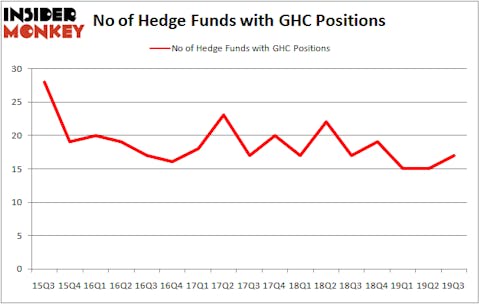

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the second quarter of 2019. On the other hand, there were a total of 17 hedge funds with a bullish position in GHC a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Among these funds, Southeastern Asset Management held the most valuable stake in Graham Holdings Co (NYSE:GHC), which was worth $309 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $122.2 million worth of shares. Wallace Capital Management, Renaissance Technologies, and GLG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Wallace Capital Management allocated the biggest weight to Graham Holdings Co (NYSE:GHC), around 10.34% of its 13F portfolio. Southeastern Asset Management is also relatively very bullish on the stock, dishing out 5.39 percent of its 13F equity portfolio to GHC.

As industrywide interest jumped, key money managers have jumped into Graham Holdings Co (NYSE:GHC) headfirst. Millennium Management, managed by Israel Englander, assembled the most outsized position in Graham Holdings Co (NYSE:GHC). Millennium Management had $0.5 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also initiated a $0.3 million position during the quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Graham Holdings Co (NYSE:GHC) but similarly valued. These stocks are Clearway Energy, Inc. (NYSE:CWEN), Bank OZK (NASDAQ:OZK), Glacier Bancorp, Inc. (NASDAQ:GBCI), and LogMeIn Inc (NASDAQ:LOGM). This group of stocks’ market values resemble GHC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CWEN | 20 | 182276 | 1 |

| OZK | 19 | 282599 | -2 |

| GBCI | 13 | 47527 | -4 |

| LOGM | 29 | 295210 | 2 |

| Average | 20.25 | 201903 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $202 million. That figure was $552 million in GHC’s case. LogMeIn Inc (NASDAQ:LOGM) is the most popular stock in this table. On the other hand Glacier Bancorp, Inc. (NASDAQ:GBCI) is the least popular one with only 13 bullish hedge fund positions. Graham Holdings Co (NYSE:GHC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately GHC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); GHC investors were disappointed as the stock returned -4.6% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.