Is Gentex Corporation (NASDAQ:GNTX) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments. More recently the top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters (S&P 500 Index funds returned only 7.6% during the same period).

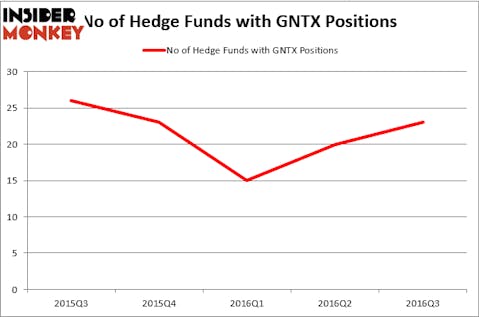

Gentex Corporation (NASDAQ:GNTX) investors should pay attention to an increase in support from the world’s most successful money managers in recent months. 23 hedge funds that we track were long the stock on September 30. There were 20 hedge funds in our database with GNTX holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as EPR Properties (NYSE:EPR), Watsco Inc (NYSE:WSO), and Post Holdings Inc (NYSE:POST) to gather more data points.

Follow Gentex Corp (NASDAQ:GNTX)

Follow Gentex Corp (NASDAQ:GNTX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

Hedge fund activity in Gentex Corporation (NASDAQ:GNTX)

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 15% rise from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GNTX over the last 5 quarters, which plummeted through the end of Q1, but have since rebounded somewhat. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Chuck Royce’s Royce & Associates has the most valuable position in Gentex Corporation (NASDAQ:GNTX), worth close to $125 million. Sitting at the No. 2 spot is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $29 million position. Some other peers that hold long positions consist of Israel Englander’s Millennium Management, Joel Greenblatt’s Gotham Asset Management, and Jim Simons’ Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, some big names were breaking ground themselves. Arrowstreet Capital created the biggest position in Gentex Corporation (NASDAQ:GNTX). Renaissance Technologies also made an $8.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Leighton Welch’s Welch Capital Partners, Mike Vranos’ Ellington, and Richard Driehaus’ Driehaus Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Gentex Corporation (NASDAQ:GNTX) but similarly valued. We will take a look at EPR Properties (NYSE:EPR), Watsco Inc (NYSE:WSO), Post Holdings Inc (NYSE:POST), and Piedmont Natural Gas Company, Inc. (NYSE:PNY). This group of stocks’ market caps are similar to GNTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPR | 20 | 172099 | -6 |

| WSO | 18 | 159826 | -2 |

| POST | 44 | 1553643 | 4 |

| PNY | 9 | 227062 | -5 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $528 million. That figure was $226 million in GNTX’s case. Post Holdings Inc (NYSE:POST) is the most popular stock in this table. On the other hand Piedmont Natural Gas Company, Inc. (NYSE:PNY) is the least popular one with only 9 bullish hedge fund positions. Gentex Corporation (NASDAQ:GNTX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard POST might be a better candidate to consider taking a long position in.

Disclosure: None